XM Review – Online Platforms, Commission, Leverage, Account Types, Features & more

About XM | Company Details

XM (formerly XEMarkets) is a Forex and CFD broker founded in 2009 and based in Cyprus. XM offers more than just CFD brokerage. Personal support, daily webinars, and free Forex market analysis are provided. Here are some of the advantages of XM:

- Low minimum deposit of $5

- Attractive loyalty program

- Demo account without time limit

- 24/5 customer support

- Regulator: ASIC, FCA, FSP, CySEC, DFSA, IFSC

- XM mobile app

- Welcome deposit for new traders

- Fixed and variable spreads from 0.6 pips

- Leverage: 1:888

Table of contents

- About XM | Company Details

- Accepted Countries

- XM Trading platform

- XM App – mobile trading from anywhere

- XM Commission or Brokerage Fees

- XM Exposure or Leverage

- Payment methods offered by XM

- Investment in Asset Classes or Market

- Free Trading Account or Demo Account by XM

- XM Offer or Bonus Deals And Promotions

- Regulation or licensing

- Additional Features

- XM Account Types

- XM – Research & Advisory

- XM Benefits

- XM Cons or Drawbacks

- Trading Hours

- Customer Support

- Safety and Security

- XM Account Opening Process

- XM Rating & Review

- Alternatives to XM

- Verdict or Conclusion

Accepted Countries

Malaysia, Netherlands, Singapore, South Africa, United Arab Emirates, United Kingdom, Germany, Hong Kong, India, Ireland, Australia.

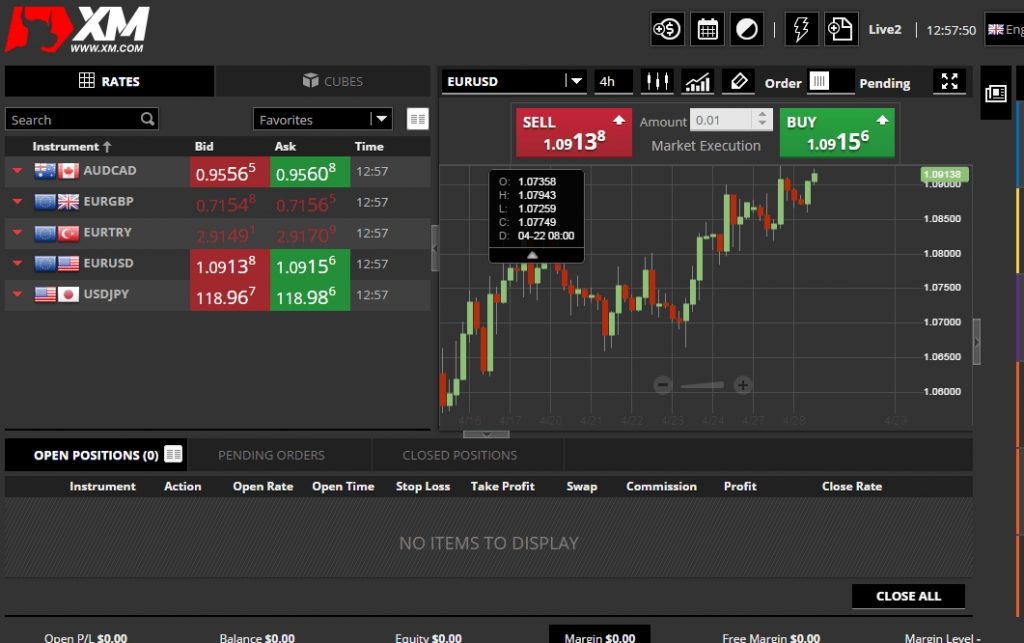

XM Trading platform

XM offers two types of trading platforms – MT4 and MT5. The MetaTrader 4 platform offers trading in foreign exchange, CFDs on stock indices, and XM CFDs on oil and gold. Stock trading is not possible on MT4. You can trade without requotes or rejections with flexible leverage of up to 1:888.

The MetaTrader 5 platform is the successor of MT4 and additionally offers access to stock CFDs. More so, hedging is allowed in MT5

Some of the features available on both platforms include:

Over 1,000 financial instruments, including stock, stock indices, forex, precious metals, and energy CFDs.

- Market research on the latest price quotations

- Full EA functionality

- Over 1000 CFDs

- One-click trading

- All order types are supported

- Over 80 technical analysis tools

- Access to 7 platforms with a single login

All these platforms are available on PC (for Windows and Mac) and Mobile (iOS and Android).

Note: If you choose MetaTrader 4, you will not get access to XM WebTrader.

XM App – mobile trading from anywhere

In addition to the desktop version, the MetaTrader 5 platform is also available as an XM app via WebTrader.

The interface is designed to be user-friendly and offers advanced features for trading on the go, giving you instant access to the global financial markets from your mobile device.

The XM app displays real-time price quotes on Forex and CFDs. With the XM app, it is also possible to place, change and delete existing positions, to manage and monitor open positions. In addition, charts can be created, and technical analyses can be made; you can enjoy access to financial market news and generate activity reports.

XM Commission or Brokerage Fees

The account management process is absolutely free. There are also no XM fees for deposits and withdrawals; the provider takes over the XM fees for all online payment services. The broker also deals openly with the applicable trading conditions and lists all XM fees and conditions transparently, enabling positive XM experiences.

XM Exposure or Leverage

The margin required for CFDs is calculated as follows:

Lots * Contract Size * Opening Price * Margin Percentage

The leverage of the trading account is not taken into account. The margin is always 50% if you hedge positions with CFDs (hedging), and the margin level is more than 100%. The broker also offers maximum leverage of 888:1. However, this value can only be used with an account size of up to $20,000.

Payment methods offered by XM

XM.com supports such deposit and withdrawal methods as credit or debit card, Neteller, Skrill, UnionPay, and bank wire. XM withdrawal options for partners include Skrill, Neteller, and bank wire. For traders, XM offers VISA.

What is the minimum deposit at XM?

XM is suitable for professional traders and small private investors because the account opening is already possible from a minimum deposit of only $5.

The broker also has negative balance protection. Since it waives an additional contribution obligation, the further private assets of the customers are not affected by the trading risk, even if leverage is traded. There is no fee for opening and account management.

In the case of more than 90 days of inactivity, a fee of $5 per month will be charged, which will only be deducted if there is corresponding credit on the customer account. Otherwise, inactive accounts are also free of charge.

XM Deposit and Withdrawal

You can use electronic methods or a classic wire transfer for the deposit. The money is credited directly to the account through electronic methods (credit card, e-wallets, Neteller, Skrill). With a bank transfer, it can take 1 – 3 days. There are no fees when depositing.

You can only withdraw after fully verifying your account. Keep in mind, however, that you have to go through the same channel as when depositing. Since XM is also regulated, the platform is committed to preventing money laundering.

Withdrawal amounts that exceed the deposit amount can be made via other payment methods, such as e-Wallet or direct bank transfer. XM always makes the withdrawal in the identical currency through which the deposit was made. If this does not match the currency of the trading account, XM will convert the amount, which may result in currency exchange fees.

Withdrawals are otherwise free of charge at XM and take place in a maximum of three working days. XM covers all transaction fees.

Investment in Asset Classes or Market

XM allows traders to invest in several asset classes:

- Forex Trading

- Stock CFDs

- Commodities

- Equity Indices

- Precious Metals

- Energies

- Shares

It supports 16 trading platforms (MT4 and MT5 for desktop and mobile) and works with the majority of global markets.

Free Trading Account or Demo Account by XM

A demo account is a virtual balance account. You can use it to try out all the features of XM broker and risk free trading. It simulates real transactions with virtual assets. It is also a great way for beginners and advanced traders to develop their own strategies or test new markets.

XM offers a free demo account with over $100,000 in virtual credit. Users can choose currencies other than the US dollar. A demo account can be used for as long as needed – this is a perfect way to get an internship with a broker.

XM Offer or Bonus Deals And Promotions

At XM, new customers can receive a welcome bonus of $30. All they have to do is fill out the registration form and open a trading account. After the subsequent verification, you can apply for the bonus credited to the account without any deposit.

The bonus itself cannot be withdrawn, but any winnings made with it are available for withdrawal. Traders can also receive additional bonus credit on the first and many more deposits at XM, which of course, represents a clear financial advantage when trading Bitcoin and other financial products.

Regulation or licensing

XM is one of the few brokers regulated by multiple financial authorities across multiple continents.

Trading Point of Financial Instruments U.K. Ltd, a U.K. company, owns XM, but you should also know that XM is formally based in Cyprus. As part of Trading Point of Financial Instruments Ltd., it is consistently subject to the supervisory authority CySEC. As an internationally active provider, XM has additional registrations with regional regulators, including BaFin, ASIC & IFSC. Compliance with the legal guidelines is regularly reviewed.

As a regulated broker, the CFD provider is required to keep client funds in segregated accounts. Client funds are managed at reputable banks in separate escrow accounts. Thus, even in the event of XM’s insolvency, the creditors do not have access to the traders’ deposits, and the broker can easily pay them out. In addition, deposit insurance is provided by the Financial Services Compensation Scheme (FSCS) so that up to$50,000 per customer is additionally protected. Traders can thus fully concentrate on trading and do not have to worry about a safe withdrawal of their funds.

Strict data protection regulations also apply. The customer data will only be used internally and will not be passed on to unauthorized third parties. Secure SSL encryption is used for data transmission to prevent hackers from attacking and to ensure that the data is protected. The company’s servers are also well guarded.

In 2018, the leverage for traded derivatives (Forex and CFDs) was massively reduced to 1:30 by the European Financial Supervisory Authority ESMA. Brokers who have a license in Europe are only allowed to offer this small lever for customers. This is a significant problem for some traders because certain strategies (like hedging) can no longer be carried out.

Additional Features

Traders can also use many other additional services at XM. The broker offers extensive educational content for beginner and experienced traders. For new traders, basic strategies are explained in video tutorials. In the regular webinars, the experienced traders go into more detail about various topics, and the participants can ask questions and actively communicate via chat.

Note that a live account is not necessarily required for participation in the seminars and webinars, even with the demo account.

XM Account Types

Traders have access to three different types of trading account with XM. You can choose between the Micro, Standard, and XM Zero account. The account types are adapted to the client’s capital strength and trading style.

For example, in the micro account, you can trade with very small position sizes (risk of a few cents). This account is often preferable to novice traders who intend to learn how to trade using a live account instead of a demo account, which is merely a simulation.

The Micro account has trade size of 1,000, and a minimum deposit of $5 is required to start trading, with a maximum deposit of $100,000. The variable leverage ranges from 1:1 to 30:1 depending on the deposit. The standard account has a trading size of 100,000, with the minimum deposit and leverage being the same as that of the micro account; there is a lot restriction of 50. As a third account model, the Executive account is on offer. Here, a minimum deposit of 100,000 EUR is required.

The leverage is 30:1; the lot restriction is 50. Clients can trade with XM.com, primarily Forex. You can choose between several asset classes such as Forex, commodities, indices, precious metals, oil.

The micro account, with a contract size of 1 lot = 1,000, offers leverage from 1:1 to 1:500, 1:1 to 1:200 and 1:1 to 1:100. For all major currencies, there are spreads from as early as one pip. The minimum trading volume is 0.01 lots for MT4 and 0.1 lots for MT5. The minimum deposit is $5.

The standard account offers a contract size of 1 lot = 100,000. The minimum trading volume here is 0.01 lots. The Zero account allows spreads from as low as 0.6 pip. The minimum amount for a deposit here is $50.

XM – Research & Advisory

XM is one of the largest providers of Forex and CFDs and enjoys an excellent reputation in the industry. Since 2009, the company has won numerous awards, which are listed on the website. In 2017, XM received the “Best Trading Customer Service of the Year” award from Capital Finance International Magazine and was named “Best Forex Service Provider” at the City of London Wealth Management Award. These awards are a testament to the broker’s seriousness and assure that it is not a fraud.

In 2019, the financial magazine Capital Finance Magazine (cfi.co) awarded the broker an award for the best customer service, the best Forex service provider award, and another award for the best market research and training worldwide. Shares Magazine awarded the broker the prize of the best Forex broker in Europe in 2018.

XM Benefits

XM trading solutions are highly praised for the following:

- Low market entry threshold ($ 5)

- Convenient software from the developer company MetaQuotes Software Corp.№

- Tight spreads

- A wide range of assets

- Availability of licenses

- Storage of funds in a segregated account

- Advisers are supported

- Scalping strategies are allowed

- Access to the simultaneous opening of several accounts

XM Cons or Drawbacks

At the same time, XM is not devoid of disadvantages:

- Newly registered users must send copies of documents by mail when creating an account

- Delays in the withdrawal of funds

- A limited selection of financing methods

- A weak training program

- Difficulties in the work of technical support

- Many critical reviews from customers

Trading Hours

When one major forex market closes, another opens. According to GMT, for example, Forex trading hours around the world change as follows: New York market is open from 13:00 to 22:00 GMT; Sydney goes online at 22:00 GMT; Tokyo opens at 00:00 and closes at 9:00 GMT; And to complete the cycle, London opens at 8:00 and closes at 17:00 GMT. This allows traders and brokers around the world to trade online 24 hours a day, while accessing central banks from all over the world.

Customer Support

If you have any questions or problems, you can contact XM live customer support 24/5, available in multiple international languages. According to our XM experience, this is available around the clock during trading hours. Unfortunately, only one telephone number from Cyprus is available for telephone inquiries, which may incur additional costs. For this, there is a point deduction in our XM review.

Inquiries can be made by e-mail. According to XM experience, e-mail requests are answered within 24 hours. However, before contacting XM Support, you can visit the provider’s FAQ page, which covers various topics and provides answers to general questions.

XM Support Facts:

- Personal account manager to help you with any questions you may have

- German support 24/5 by phone, e-mail, or chat.

- Almost daily webinars for beginners and advanced users

- Daily market analysis and real-time market news

Safety and Security

There are quite contradictory opinions on the work of the XM.com broker on the network. Some users claim that it is trustworthy and offers quite loyal trading conditions. In turn, other forum participants do not know how to achieve a return of the money earned.

Some dealer’s clients have noticed that after the withdrawal request was assigned the status “Pending”, the technical support service instantly ceases to be in touch. Also, users reported fraud due to the hacking of accounts immediately after depositing funds.

However, from the legal standpoint, XM Trading is absolutely clean. In addition to having an FCA license, the XM broker is regulated by several other organizations:

- CySec (# 120/10).

- IFSC (# ISC / 60/354 / TS / 17).

- ASIC (# 443670).

Also, bodies such as AFM, FIN, BaFin gave their permits to conduct financial activities. The broker’s official website contains a complete list of licenses

XM Account Opening Process

You must have verified your trading account with a correct passport or ID and proof of address by electricity bill or similar proof of address document.

The XM Support staff thus ensures that the personal data provided is correct and that it can be ensured that customers’ deposits and their account details are secure.

XM Rating & Review

XM has a pretty high rating but customer reviews are contradictory. Users are mostly unsatisfied with withdrawal time and slippage.

Alternatives to XM

The following platforms provide pretty much the same functions as XM:

- eToro

- Evotrade

- Orbex

- FXCM

- Atas

- Fx Open

- Alpari

- Lite Forex

- iForex

- Instaforex

Verdict or Conclusion

XM offers over 1000+ tradable instruments. No trader should lack choice here. As mentioned above, a variety of markets are offered. Traders can use the popular financial product CFDs (Contract for Difference) to invest in rising or falling prices. They include Forex Trading, Stock CFDs, Commodity CFDs, Indices CFDs, Precious Metals CFDs, and Energy CFDs.

XM relies on several different account types, which give traders the best conditions depending on the capital strength. Spreads can start from 0.0 pips on the most traded markets. In addition, the execution is carried out very reliably, and there are 100% no requotes.

As a trader, you can start trading from as little as a minimum deposit of just $5. The maximum leverage for European regulation is 1:30, but it can be upgraded through a professional account. You must meet certain requirements (you can get the exact instructions from XM).

More so, when you open an account, you will receive a $30 trading bonus at the start, for which no deposit is required. You can choose between different types of trading accounts.