How To Trade Using Breakaway (Or Breakout) Gap Trading Strategy

The risky aggressive approach to the breakaway gap can get investors into more trades while the conservative approach allows the trader a stronger stop-loss order.

In stock trading, a gap refers to the difference in prices between the closing and opening of the stock market, two days in a row. On a chat, a gap can also be described as an area where prices of stocks move rapidly up and down with minimal trading and shows a gap. Traders may interpret this type of gap as profits. In this article, we explain the breakaway or breakout gaps in detail. We explore how they occur, why they occur and how you can utilize the breakaway gapping strategy to gain profits while trading.

Contents

Gap Trading Approach

When major news or a significant event is happening, gaps occur. This causes a flood of sellers and buyers in the market to make different trade decisions. The result is that the prices are significantly higher during opening or lower than the previous day’s prices. A type of gap indicates whether it’s the start of a new trend or a reversal of a previous day trend.

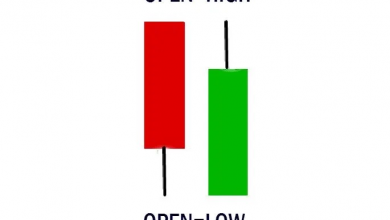

Typically, gapping occurs when the prices of assets open over or beneath the previous day’s close without a trading activity happening in between. Sometimes some gaps can occur due to the opening price becoming more or less than the past day closes. But this happens in the past day’s price range. Full gapping happens when the opening price is way out of the past day’s range.

Classification Of Gaps

Gaps are categorized into four different types.

- Breakaway or breakout gaps.

- Runaway or measuring gaps.

- Exhaustion gaps.

- Professional gap.

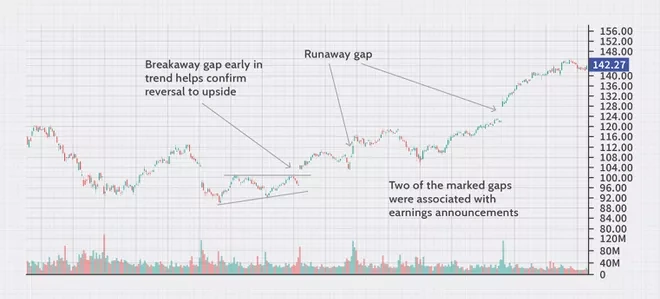

The Breakaway Gap

A breakaway gap points out price movements through resistance or support. This type of gap arises when the price gaps beyond resistance or way below the support. In this instance, the support and resistance correlate to the chart patterns like a wedge, triangles, the trading angle, or any other patterns.

How The Breakaway Gap Operates

There are instances where prices break out of a good trading range through a gap. This is referred to as a breakaway gap. such gaps can materialize from any chart pattern like a top, head or shoulders type of pattern. It can be used to identify a new trend and can happen anytime. Most likely, they happen after major corporate news has been released.

Trading With The Breakaway Gap

There are two critical methods applied when trading with breakaway gaps.

The Aggressive Method

As the word suggests, the aggressive method means to get in the trade immediately after a breakaway gap. This method can get investors into more trades, but the risks sustained are much higher.

Traders must first put the first stop-loss order beneath the consolidation sequence to exercise this strategy. Then they proceed to find chances to secure it as the breakouts work out. If you see that putting the stop loss beneath the consolidation pattern is very risky, then choose the volatility stop losses as an alternative.

The Conservative Technique

This method means entering the market in a pullback style. Usually, the pullback tests the gap, but in this instance, it is not essential. The main issue is that traders can miss prominent trends that do not provide pullback entries. The upper hand to entering the market in a pullback fashion is that you get to place a much stronger stop-loss order.

How Do You Identify And Scan Breakaway Gaps?

With the advancement of technology, it is effortless to scan for charts’ gaps. A lot of different stock scanners are now available in the market. Before using a stock scanner, you need to manually review the charts to decide whether it is a breakaway gap or not. Some of the scanners you can consider include Barchart, Marketinout and Stockbeep.

The earnings calendar is also a way to identify and scan for gaps. This technique needs investors to look out for stocks about to report their financial earnings. Traders can also look out for stocks trending in a consolidation pattern. These are anticipatory steps that can help traders identify ways to trade using breakaway gaps. You can look out for some earnings calendars: Bloomberg, Yahoo Finance, and Seeking Alpha.

Criteria For Pointing Out Breakaway Gaps

There are four ways investors can single out breakaway gaps in a chart.

- High volumes are primarily due to how critical bullish breakouts are

- Gapping out of a consolidation pattern

- The gaps do not fill fast. This criterion proves that the first two criterions mentioned above have their requirements met.

- Significant events are always affecting breakaway gaps. Important news and announcements are a vital part of identifying breakaway gaps. News that affects stock and other financial assets drive the development of many breakaway gaps.

Fundamental Techniques For Gap Trading

Three essential tips make the gap trading strategy to be successful.

Use of Indicators

Various tools such as the RSI can be used to determine significant price points and inform any other critical decisions, such as when to enter a trade after a gap.

Gap Prediction

Both technical and fundamental factors can pinpoint potential gaps for the following day. For instance, knowing about a certain company and how they carry out operations may help traders predict gaps for the said stock way before the earnings report is released.

Gap Fading

This is an instance where gaps get filled within the same trading day. FOMO usually causes the volume that brings about this gap.

Gap Trading Guidelines

There are some rules to keep in mind before embarking on gap trading.

- Categorize the gap you have chosen. Out of the four types of gaps listed in this article, get to know which one you will use and why.

- Be on the lookout for volumes. A lot of breakaway gaps possess extremely high volumes. Exhaustion gaps, on the other hand, exhibit significantly low volumes.

- Be cautious as gap trading means trading on volatile markets. These stocks have low liquidity. So, ensure you are in the right state of mind to manage risks appropriately.

- Because of local immediate resistance or support, they most likely do not stop when the gaps start filling.

- Wait for prices to begin breaking prior to taking positions. This is because many new investors who have little experience may showcase irrational excitement decisions that set up an exhaustion gap.

The Takeaway

Investors must identify the various underlying factors behind a specific gap correctly. Get to know what type the gap is when you increase your chances of a successful trade. Every space between candlesticks is vital in trading; therefore, you can’t ignore gaps. The secret to a successful trade is taking note of consolidation patterns as you get ready to set up breakaway gaps. The greatest reward to risk ratios come from breakaway gaps. Take your time to pick the right ones and get good profits.

However, trades can also result in losses. To avoid this, you need to do due diligence, research, and learn about various types of trades and how they operate. If a high-volume resistance stops a gap from being filled, then recheck the speculation of the trade. Do not proceed with the trade if you are not sure it is correct.