Do you want to day trade? You’ll need top-of-the-line day trading software. The best day trading software should improve your trading experience while assisting you in achieving all of your investment objectives. This implies it should include all of the features and analytical tools you’ll need to put your approach into action.

This post will show you how to choose the finest day trading software based on the factors that matter most to investors. These range from the finest beginner-friendly software to the best software available for no cost.

Contents

Read through this article to find out the best day trading software 2022, and everything you need to know about them.

DAY TRADING SOFTWARE 2022

Any software that assists you in analyzing, deciding on, and executing a transaction is referred to as day trading software. It might provide you with all of the technical analysis and indication tools and materials you require. Furthermore, it could also help you in locating the best trades while executing them accordingly.

Whether you are new to trading, and you’re in search of the trading software that is made for beginners, or you are an expert searching for advanced trading software or expert trading software with more features than ever before, doing your homework will never be more vital.

HOW DOES TRADING SOFTWARE OPERATE?

There are four types of day trading software available online:

1. Data.

Data is very important in stock markets. Information about the prices of the stock you wish to trade would help you make best predictions as regards the possible next movement of the stock. These details are generally obtained from the point where they are traded. Forex, on the other hand, lacks a central exchange.

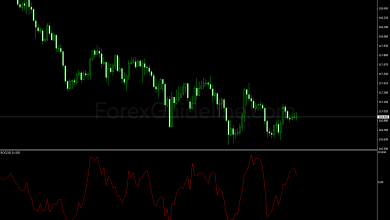

2. Charting.

Clever traders will use charting software to plot prices. Data streams will be available from several suppliers. Basic technical analysis indicators are generally included in these charting programs. If you upgrade to a more advanced package, you’ll have access to more indications as well as the opportunity to validate your methods.

3. Trade completion.

Once you have your data and have analyzed it on a chart, you’ll want to place a trade. You’ll need trade execution software, often known as an electronic trading platform, for this. With an application programming interface, you may create your trading strategies with a lot of modern software. They may also provide you with day trading-specific automated trading features.

4. Brokers Vs Independent Vendor

While many of the software provided by brokers are directly linked to their in-house system, the trading software provided by some independent vendors is totally free of this. Accessing this service provided by the independent vendor is known as using the third-party application.

IMPORTANCE OF DAY TRADING SOFTWARE

A computer application that assists clients in trading efficiently is referred to as day trading software. It’s generally available through brokers, and it’s made day trading more accessible to newcomers. Some speculate that the availability of day trading software has led to a rise in day trading, which has pushed the market higher.

In fact, in April, the stock market reached new highs for the first time in 20 years, and May wasn’t too terrible either. The trading program automates the analytical process and executes transactions, allowing the owner to reap maximum earnings that they would not have otherwise.

Day traders, or mere humans, for example, may find it difficult to monitor two technical indicators on two or four different stocks at the same time. It’s challenging enough to learn how to apply technical analysis. But how well would day trading software perform? Flawlessly. It was designed just for it.

Of course, there are a plethora of day trading software options, each with its own set of features and capabilities, making it difficult to choose the ideal one for your interests.

BEST SOFTWARE FOR DAY TRADING 2021

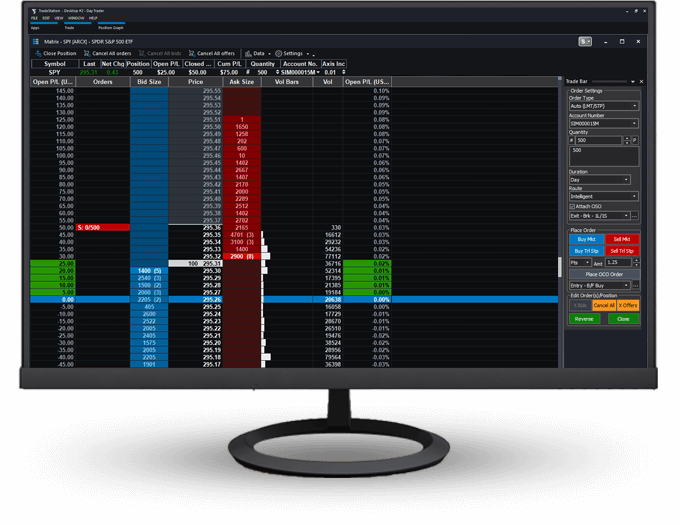

1. TradeStation

In recent years, TradeStation has stepped up its game. The TradeStation trading platform now provides a TradeStation GO account option, which allows novices access to expert stock screeners and a rich library of instructional information and development tools, whereas it previously only catered to professionals.

Another advantage of TradeStation is the sheer number of options accessible to traders. From ETFs to equities, cryptocurrency to futures, the company has it all. The materials and instructional tools complement all of these items. Furthermore, TradeStation, like the other brokers charges no fees on equities and most ETFs.

Pro: Great website and mobile operating software, affordable ETF and stock charges, and high-quality instructional resources

Cons: There is no FX trading.

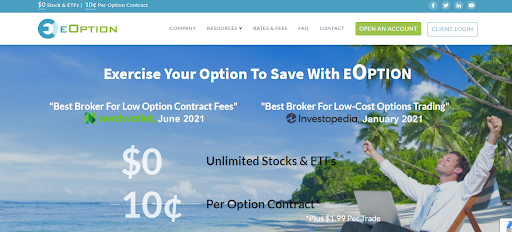

2. eOption

For individuals wanting to trade on a tight budget, eOption’s day trading program is excellent. It has a modest fee of $3 per trade and requires a minimum deposit of $500 to create an account. Only highly qualified brokers, such as Interactive Brokers, can beat these costs.

eOption has a desktop and mobile trading interface, both of which provide a comprehensive set of features, up-to-date quotes, and live broadcasts. Day traders considering joining eOption should keep in mind that the cheap costs are offset in various ways.

Pros: Comprehensive instructional content, low-cost alternatives contracts, and a $500 minimum account fee is required.

Cons: Lack of assistance

Generally, eOption’s day trading software will appeal to more skilled day traders that use external research and charting tools and intend to use the platform only for trade execution.

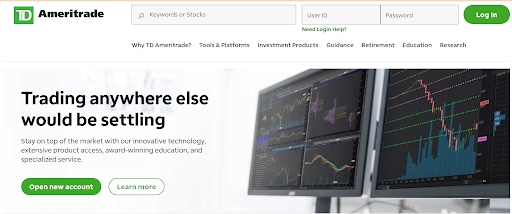

3. TD Ameritrade

TD Ameritrade is a renowned broker that provides day traders with a wide choice of platform options and tools to assist them to maximize their earning potential.

Traders may access a variety of learning resources, including a comprehensive collection of instructional videos and articles, investment analysis tools, and live chatbots to answer any pressing questions.

The well-known thinkorswim platform from TD Ameritrade will provide you with customized PaperMoney, charting software, and trading indicators, a risk-free digital model where you may practice your transactions. TD Ameritrade’s Mobile Trader software, which has all of the same features as the desktop version, is a must-have for day traders and mobile traders alike.

Pros: Low trading commissions, a desktop trading program that is second to none

Cons: extensive study and data, Fees aren’t disclosed.

On the negative side, day traders who want to use this trading program will have to pay $7.00 for each trade, which may quickly mount up at the end of the day. This trading program, on the other hand, is one of the best, with a $0 account minimum and no inactivity or yearly fees.

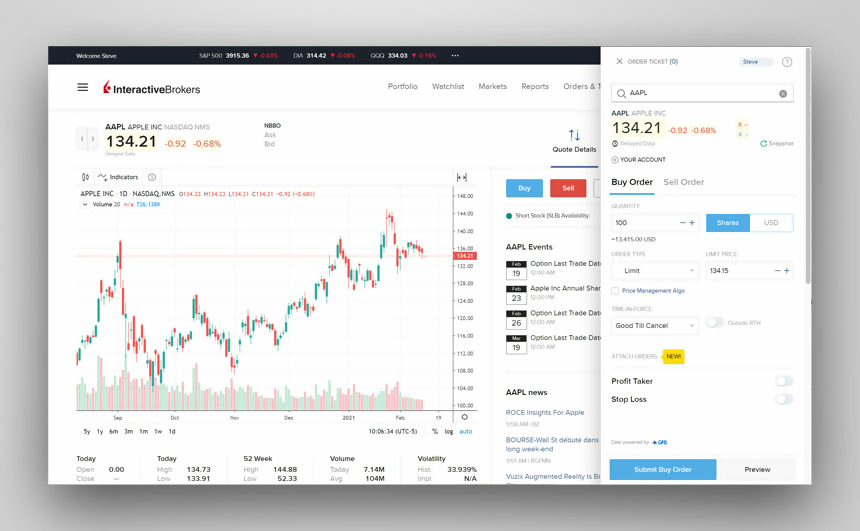

4. Interactive Brokers

Because it focuses on providing active, experienced day traders with a high-quality platform to meet their trading aims. Interactive Brokers is one of the top day trading software. Long-term or occasional merchants, on the other hand, do not need to apply.

You won’t have to pay anything to open an account with Interactive Brokers, but if you have less than $100,000 in your account or don’t generate a minimum of $10 in trading commissions each month, you’ll have to pay $10 monthly charge. Although a cost of $10 may make you want to run for the hills at first, consider that some other brokers charge between $4 and $7 for each trade, whereas Interactive Brokers has the lowest fees in the business.

Pros:

- For high-volume traders, low fees and discounts are available

- A wide range of asset types and worldwide marketplaces are available.

- For big-volume traders, there are significant savings.

Cons:

- Beginners may not be able to use the platform.

- There are no FX charts available.

- Fees for minimum activities

Day traders will also be charged a fee of $.05 for every equity traded, with just a limit of $1 and a maximum of 1% of the trade value. IBKR provides additional discounts to high-volume traders when it comes to bargains.

5. Firstrade

Day traders may trade ETFs, stocks, and options with Firsts Trade for no commission. Its webpage, including its Chinese language offerings, are well-known for their ease of use.

Firstrade’s trading desk is ideal for Chinese-speaking traders since it provides help to Chinese-speaking clients 24 hours a day, seven days a week. The broker’s web platform is a little old, but its mobile app, which was redesigned in 2020, is smooth and sleek. Many people enjoy how simple the website is to use.

Pros:

- Options contracts with a value of $0

- Mutual funds with no commissions

Cons:

- Language proficiency in Chinese is a disadvantage

- Account charge for outbound transfers is higher.

Morningstar, as well as the broker’s overall balanced research experience, will assist day traders. For ETFs and equities, Firstrade provides a third-party research report. Mutual funds, on the other hand, do not have a report.

While there are no inactivity fees with Firstrade, there is a $65 outbound transfer account cost.

6. Forex.com

For day trading software, FOREX.com is another world-class broker. With a variety of trading platforms, reasonable pricing, up-to-date market analysis, and a high-quality mobile app, it provides an excellent trading experience for FX and Commodity traders.

With a simple yet well-designed user interface, Forex.com’s sophisticated trading platform will be all most traders need to achieve their objectives.

US traders will be pleased to learn that, in addition to the other accounts, thus, enabling them to have a direct access to the software. You may download the app for iOS and Android as soon as you create an account, and enjoy all the features, fully loaded; an integrated tool to analyze, and complex charts.

Pros:

- Mobile and PC functionality is excellent.

- Account options are important for active traders.

- Cons are well-regulated and regarded as safe.

- Many rivals have lower spreads.

- Accounts are not protected against negative balances.

Usage of breaking news and economic calendar would be handy to get the best result using this strategy.

7. E*TRADE

E*Trade has expanded its features significantly over the years, earning it a spot on our list of the top day trading software.

E*Trade offers three interfaces, each tailored to a different type of trader: E*Trade online, E*Trade Pro, and OptionsHouse.

E*Trade pro, as you might expect, provides a professional array of analytical tools and services in general, but you’ll need at least $280,000 in your wallet.

Pros

- Robust smartphone app for free stock and ETF trading

- Data analysis are made easy with the complete set of tools and other features.

Cons

- Commissions are higher than those offered by several rivals.

- The least account balance that is acceptable is $200,000.

You’ll love E*Trade’s mobile app if you’re a mobile trader. It’s quick and easy to use, and it lets day traders make orders and follow stock quotations in real-time.

It is also important to note that E*Trade’s fees are a little bit higher than that of its competitors. Fortunately, new traders are given a 50-day free trial to see if it is all they need. One thing to keep in mind is that if you want to create an account, you’ll need a minimum deposit of $15,000.

DAY TRADING SOFTWARE STRATEGIES

Choosing the proper software is crucial, but part of that choice also includes ensuring that it is compatible with your day trading methods.

TradingView, for example, may assist you in developing and back-testing strategies, even utilizing your code if needed. If you have a complicated plan, though, you may require software that includes all of the indications and technical tools at your fingertips so you can make quick and precise judgments.

Your strategy requirements are likely to be larger, and you may demand pricey sophisticated features.

Demo Accounts

A demo account is an ideal method to try a certain piece of software before committing to it.

A demo account is a type of practice account that allows you to trade for free using “imaginary money” while using genuine software and features. It’s a fantastic opportunity to try out new tools, techniques, and abilities, and we strongly suggest it.

Regional Effects

Customized for a specific market

In the Indian and South African markets, the finest trading software for Australia and Canada may fall short. This is because Indian software might be very different from Australian software.

Spider software, for instance, specializes in technical analysis tools for Indian markets. However, if you want to trade stocks in the East, you could discover that software from far away won’t provide you with all of the market data and news resources you’ll need.

There’s also the issue of price. For Indian markets, there is lots of free charting software available, but the same strong and extensive software in the UK, Europe, and the US may frequently be expensive. As a result, make sure your software comparison includes both location and pricing.

Consideration of Taxes

Day trading tax software follows the same premise. Accounting software must be able to properly compute the amount of tax due to your country’s specialized body, such as the IRS. Apart from wasting your time, any tax mistakes, as well as any fines, will fall on your shoulders.

HERE’S A CHECKLIST OF FEATURES TO LOOK FOR IN DAY TRADING SOFTWARE.

1. Day Trading Requirements

Consider if you want to go for a simple or more complicated day trading plan. Will you require a currency feed, or will you be trading specific products such as options? If that’s the case, you’ll need the right tools to execute an options trading plan. Do not rely solely on the broker’s marketing promises. Make use of virtual models to test it out for yourself so you can have a good idea of how it will function for you.

2. Platform Neutrality

Unless you intend to use a highly complicated algorithm for your day trading, the use of web-based software is highly recommended. This will be more convenient for connecting from anywhere, as it will not require any installation or maintenance. If you want to use a more complicated method, however, you should consider purchasing computer-based software. Keep in mind that it will not be inexpensive.

3. Other Features

News, among other things, drives day trading methods that deal with short-term market fluctuations. Will you rely on real-time news, data streams, or charts in your strategy? If you answered yes, be sure you can access them through the program you pick; otherwise, you may have to connect to them through third-party sources, which will raise your expenditures.

4. Analytical Characteristics

Determine whether analytical features are available in the software. Consider the following options:

Traders who want to anticipate future price levels and directions will need to use technical indicators. Once you’ve decided on the technical indicator you’ll use, check to see if your day trading program can support the trade automation procedure.

Recognition of Arbitrage Opportunities: This is what you’ll need for the arbitrage strategy. It buys and sells the stock on both marketplaces at the specified price difference, allowing you to profit quickly. You’ll need to be linked to both marketplaces and be able to examine price discrepancies in real-time to do this.

Mathematical tactics: Some methods rely on mathematical theories, such as a delta-neutral approach, which allows traders to trade options and the underlying securities while balancing positive and negative deltas to keep a portfolio at zero. The day trading program should be capable of allocating holdings, verifying market pricing, and executing transactions as needed.

Beyond a doubt, mathematical tactics are a broad category of techniques that are generally carried out using day-trading tools.

5. Fees and other factors to consider

As can be seen, when it comes to day trading software, the possibilities are endless. These days, everything can be computerized, let alone personalized.

Apart from selecting the finest day trading software, you should also test the techniques you’re contemplating on historical data, calculate the profit potential after factoring in the fees of the day trading software, and proceed from there.

When searching for the finest day trading software for your interests, consider the following factors.

6. The Software’s Price

Some day trading software is included with the brokerage account, while others charge extra for its use. Perform a cost study and compare several versions and attributes. While the majority of software is free, it may not have all of the functionality you want to maximize your trading.

7. Accurate pricing.

Check to see if the day trading program enables national best bid and offer (NBBO). Using an NBBO participating broker guarantees that your trades are performed at the best bid and ask price available. This, however, will be determined by the rules in each nation.

8. Features to Protect.

Although having software that can make you money is appealing, security is paramount.

As technology has progressed, “sniffing algorithms & software” aimed at identifying other side orders have become accessible. These are designed to allow owners to detect orders from the opposite side. It’s important to think about this.

PREREQUISITES FOR DAY TRADING?

It is essential to put the following at pace before even thinking about commencing your trading. Take a look at the list.

Capitalization

This is the first important thing to consider and put in place as you begin your trading venture. Money is needed to acquire your stock, fund your account and enable you to participate in the financial market. Although many brokers out there allow traders to start participating in the financial market for a low amount, as low as $100, for you to make a meaningful gain from the financial market, you need to fund your account with a substantial amount.

It is generally advised that newbies to the financial market should start with $500, and thereafter, they can add more to their wallets as the case may be.

It is also important to note that your broker can suspend your trading right. This is only possible once you’ve used up your weekly limit of three square transactions. You are either expected to make a deposit to bring your account up to $20,000 in value or you wait till the commencement of the 5-day session.

Because of the restriction of the low-level day traders’ accounts, it is advisable to be very careful about what they purchase and sell.

Trustworthy Live Quotes Source

As a day trader, you will definitely need a trustworthy quote source to be able to determine when best to purchase and sell.

Attainable Aspiration

One of the most important tools in trading is your mindset. You need the right mindset to be a successful day trader.

One such mindset is that of perseverance and commitment. It takes time to master stock trading. Many skilled traders admit that it took them over 8months to start seeing consistent returns, in addition to numerous hours of training on a dummy account.

Have clear expectations for how much income you’ll make, and don’t be afraid of making errors as they’re a necessary part of the learning process.

FINAL THOUGHT

Investigating the finest day trading software and computer programs may open up a world of possibilities. Don’t allow the prospect of generating money at the press of a button to cloud your judgment; it is essential to know every bit of information about the software you’re using, what it can do, and what it could be lacking.

Identify the best trading software that suits you and your proposed market. The details discussed in this article would help you out with this. And by carefully adhering to it, you’ll be on the correct track to profiting from day trading if you properly evaluate day trading software and have a strong knowledge of your trading approach.