10 Best 80C investment options

How to make more profit with investments? Choose options under Section 80C. Discover 10 best 80C investment options for Indian residents and interest rates available

Contents

Section 80C is the most broadly utilized segment for asserting Income Tax Deductions. This Section which permits an allowance of Rs. 1,50,000 can not exclusively be utilized by Salaried Individuals however can be utilized by all classes of Tax payers independent of the source from which they are acquiring their pay.

A Deduction from the taxable income is allowed with specific determined instruments and this deduction can be asserted under Section 80C. The highest deduction which can be asserted under Section 80C is Rs. 1,50,000.

This Deduction of Rs. 1,50,000 can be guaranteed either for interest in a solitary instrument or for interests in numerous instruments. The all out aggregate compensation that would be permitted would be restricted to Rs. 1,50,000.

There are a few instruments wherein an individual can contribute and guarantee derivation under Section 80C. The 10 most popular instruments which can be allowed as a Deduction under Section 80C have been examined underneath.

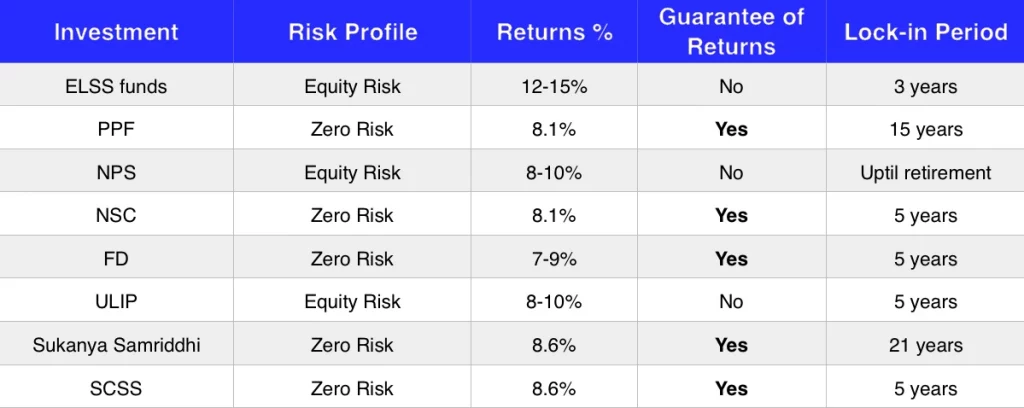

Comparsion: The most popular 80C investments

Without further ado, let’s check out the 10 most popular investments under section 80C.

1. Equity Linked Mutual Funds

Deduction under Section 80C is additionally tatking into account interests in Equity Linked Mutual Funds. It should be noted, here, that the deduction isn’t taking into account all Mutual Funds – it works only with Equity Linked Mutual Funds also called ELSS Funds. The words – Tax Saving are additionally referenced on these assets.

These assets can be held either in Demat Account or in Physical Format. You can even buy these from a specialist and mention the Demat Account Number in which you wish to get the Mutual Fund Investment. Some internet based trading accounts additionally have the service of buying shared assets on the web.

There is a lock-in time of 3 years in these Equity Linked Mutual Funds and you are not allowed to sell these shared assets before the due date under no circumstances.

2. Life Insurance Premium

The Life Insurance Premium paid by you for protecting lives of you, partner and kids is additionally permitted to be asserted as a deduction under Section 80C.

In any case, it is appropriate to note here that the life insurance premium paid for guaranteeing the existence of guardians isn’t permitted to be asserted as a deduction.

3. Public Provident Fund (PPF Account)

Any individual whether or not Salaried can put savings into PPF Account and acquire fixed revenue on the equivalent. The pace of revenue on PPF Account continues to change after customary extensions and is chosen by the Government. The pace of revenue on PPF Account in Section 80C is typically much higher than the loan cost on Fixed Deposits.

PPF Accounts are opened for a time of 15 years with a lock-in time of 5 years. You can pull out a specific sum from PPF Account after the fifth year with practically no prepayment punishment. Note that sometimes, no deduction is not allowed.

4. Employee Provident Fund (EPF Account)

Employee Provident Fund is a retirement benefit that is accessible just to Salaried Employees. In this plan, both the business and the worker contribute to a specific organization each month and premium is paid at standard spans on the sum in the EPF Account. Pay attention that no deduction is allowed if the sum of investment is withdrawn after 5 years.

5. Stamp Duty paid on Purchase of a House

The sum paid as Stamp Duty on the acquisition of house and the sum paid on enlistment of records can likewise be asserted as a deduction in the time of procurement. Hence, when buying a house, you can also make an investment that won’t be taxable.

6. Deduction of major part of home loan

Deduction under Section 80C is likewise taking into account reimbursement of the larger piece of Home Loan. Derivation of Interest on Home Loan isn’t permitted under this Section but is permitted under Section 24.

7. National Savings Certificate (NSC)

National Savings Certificates (NSC) are fixed acquiring instruments given by the Government of India. There are 2 sorts of NSCs: one with a span of 5 years and the other with a term of 10 years (it’s an example). Today, the average interest rate of NSC is 6.8% p.a, which is higher than some regular bank deposits.

Who should make an investment in NSC?

Anybody searching for a reliable way to procure a consistent profit while saving money on taxes can put resources into NSC. NSC offers ensured interest and complete capital insurance. However, like any other type of investment, they can’t guarantee huge tax-beating returns like tax saving mutual funds and the National Pension System. The public authority has allowed NSC mostly for prospective investors by making it accessible in official post offices across the country.

The public authorities have advanced the National Savings Certificate as an investment funds plan for people. Thus, Hindu Undivided Families (HUFs) and trusts can’t put resources into it. Moreover, even guests of the country can’t buy NSC certification. This investment scheme is allowed only for individual Indian residents.

8. 5-Year Tax Saving Fixed Deposit

Derivation under Section 80C is likewise considered interest in long term fixed deposits. It is relevant to note here that it isn’t generally considered to be a fixed deposit, however it is usually locked for 5 years or more. As for deduction, it’s regular – up to Rs 1.5 lakh.

9. Senior Citizen Savings Scheme

Senior Citizen Savings Scheme is a proper tax deduction instrument on which interest is paid consistently. Under Section 80C, people are allowed to open Senior Citizen Savings Account in any postal station across India and in some offices of Nationalized and Private Banks.

10. Interest in Sukanya Samriddhi Yojana

The investment called Sukanya Samriddhi Yojana is made for the government assistance of a girl child and is allowed under Section 80C. The profit paid on the Sukanya Samriddhi Yojana is a real capital saver. It is exceptionally rewarding and is additionally tax-exempt as no duty is exacted on the profit procured on this record.

Bonus: Education Fees of Children

Investment under Section 80C is likewise taking into consideration payment of School Fees fpr up to two children in the family. This deduction is permitted in the financial year where the payment is made and is accessible for the charges paid for full time training of kids in India.

Charges paid for low maintenance courses or training classes or for schooling outside India isn’t permitted to be asserted as a tax deduction under Section 80C.

Key takeaways

- Anybody searching for a more limited lock-in period and looking for a reliable return with a tax saving option should consider investing in fixed deposits (FD).

- How to open a saving FD? You can open an account on the web or at a bank office. Various banks offer interest percentages on saving FDs, so it is recommended to look at rates before you make a deposit.

- Are saving FDs safe? Yes, this is a risk-free form of investment. The sum you store in a bank or a governmental organization is secured, and the profits are likewise ensured.

- Fixed deposits under section 80C come with a decent financing rate that cannot be affected all through the 5-year lock-in. The loan fees for Indian residents, HUFs and NRIs shift from one bank to another and get updated all the time. Senior residents and bank staff individuals are offered higher loan fees. The interest is available, deduction is available at withdrawal, and will be added to the deposited sum

- The lowest interest that can be made with a deposit is Rs 100.

- Individual record holders can get a personal expense derivation of up to Rs 1.5 lakh each financial year. On account of joint holders, this tax break is accessible just to the main holder of the account. The other account holders can’t use this advantage.

- Since FDs under Section 80C have a lock-in time of 5 years, no untimely withdrawals, credits, or overdraft services are available during this time.

FDs under Section 80C are allowed for: native Indian residents, senior residents, HUFs, and NRIs.