Engulfing Candlesticks: How to Trade with Bullish and Bearish Patterns

There are two main candlestick patterns in the foreign exchange space. The bullish engulfing pattern and the bearish engulfing pattern. These trends are essential to traders as they indicate whether the market is about to change direction. This article expounds more on the engulfing candle pattern and how to use it to trade in the forex market.

What Is Engulfing Candlesticks in Trading?

A candlesticks body represents the beginning and end span of each trading session. This period can be either a second, a minute, or even a month-long or maybe more depending on a trader’s chart context. Both bullish and bearish engulfing patterns are a vital part of technical analysis in FX. You can use these trends to point out reversals in forex trade.

Learning the Engulfing Candlestick Pattern

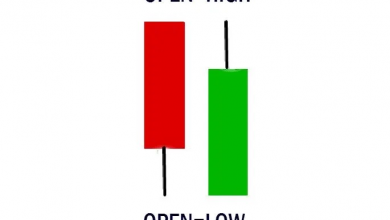

An engulfing pattern comprises two different bars on a single forex chart. These trends are used to indicate any changes in the market. In such a case, the second candlestick is bigger than the first one. This ends up fully enveloping or engulfing the length of the preceding bar. There exist two different categories of engulfing candlestick patterns. This approach indicates how the market switches its course following a preceding trend. These are the two different engulfing trends explained depending on the order of the candlesticks:

- Bullish engulfing pattern

- Bearish engulfing pattern

Bullish Engulfing Approach Expounded

The bullish engulfing pattern incorporates a pair of pattern types that appear at the bottom of the dipping trend. Here, the second candle entirely envelopes or covers the body of the previous candle. As the name bullish suggests, this kind of trend makes a trader go long. Such trends provide very strong signals on a downward trend. This indicates that there is a surge in buying thereby prompting a reversal of an active approach.

What Do Bullish Engulfing Candlesticks Mean to Traders?

Large bullish patterns indicate that buyers are flooding into the FX market. Traders then find an indication that the trend is truly turning around. Price changes show a downward trend as soon as the bullish pattern appears. These show traders that buyers are in control of the market, after a previous run. This engulfing candlestick is considered a signal to buy the market or go long by traders. It is also a pointer for those in a short position to contemplate closing their trade.

Bearish Engulfing Candles Expounded

The opposite of a bullish pattern is the bearish engulfing trend. This type of pattern is made up of a short green candle that is fully enveloped by a red candle. The initial candle signifies the bullish patterns were in charge. The second candle indicates that these trends pushed the prices much lower. Here, the next session starts higher than the preceding session but ends remarkably low.

What Do Bearish Engulfing Candlesticks Mean in FX?

These show traders that the market will enter a downward trend after a previous price increase. This reversal trend is an indication that bears have taken over the forex market and could push the prices further down. This is a sign for traders in a long position to contemplate closing their trade. It also serves as an indication for traders to get into a short span in the market. For new entrants to trading, it is advisable to use a demo account when practising with engulfing patterns.

Importance and Limitations of Engulfing in Forex Trade

The significance of candle patterns is very essential when it comes to being successful in forex trading. Traders capitalize on every new trend in the forex market. As reversal patterns, bearish and bullish tendencies indicate an imminent change in the price direction.

The second candle is huge. This may leave a trader with a big stop-loss if they decide to trade using the bearish trend. Candlesticks do not provide a specific price target. This makes it difficult to establish potential rewards.

Engulfing Candlesticks in Trading

For a trader to identify a pattern in reversals, they must use engulfing candlesticks. It is an important part of the technical analysis approach in the FX trade. Candles are quick indicators of whether market prices will go up or down and this is very essential considering the volatility of the forex market.

Before using engulfing candlesticks, you need to start with a demo account for training in a low-risk environment. After you are sure you have learned enough, go ahead, and sign up for an actual trading account. It is vital to put your technical analysis knowledge into action so as not to suffer a loss easily.

Basic Rules of Engulfing Candlesticks

- Check when the price closes at the specific confirmation candle and open a transaction.

- Set a stop-loss request on the other side of the engulfing or covering formation.

- Until there is a minimal price move same as the size of the engulfing pattern, stay in the trade.

- Extend the duration of your trade by utilizing price action guidelines.

How to Trade Engulfing Patterns

- Identify the trend. Observe the direction of the strongest trend. This dictates the direction you are to trade in. upward trends are signaled by upper swing highs and more high swing lows. Traders should utilize long positions in this case. Take advantage and buy at this time then sell later when the prices spike.

- Wait and watch for a pullback. If you cannot see any trend clearly, abort this strategy immediately.

- Enter the trade. Once you notice a specific pullback, begin a transaction by utilizing the candle approach. Then put a stop loss over the current high in case of short positions. In the case of long positions, way beneath the current low.

- Exit the trade. Exit the entire trade if the trend tends to reverse by making a high ranking high and a low ranking low during a downward trend. If you are in a long trade, exit trade if the trend makes a lower high and lower low during an upward trend.

Variations of Bullish and Bearish Engulfing Trends

These two are the direct opposites of each other. A bearish pattern materializes when a price shifts higher and predicts much lower prices are about to come. A bullish engulfing pattern activates when the price shifts lower and indicates that prices higher prices are to be expected. A bullish candle has a rather large shape that wholly envelopes the tiny candle. One way to look for a high price action is to look for a trend that appears at significant resistance or support levels.

Key Takeaways

Engulfing trends are used to signify market reversals in transactions. Both bullish and bearish engulfing approaches are considered as notifications to enter a trade after price changes have occurred. As a common technical analysis strategy in the foreign exchange space, always consider practicing with a demo account before risking your money in a live trading account.