Shooting Star Candlestick Pattern: Definition and Applications

A shooting star is a type of bearish candlestick with a super long upper shadow and a shorter or no lower shadow. The bearish pattern on an uptrend when the open, close and lows are almost the same price. In this article, we will look at everything you need to know about the shooting star, including how to identify it, how to use it in technical analysis, and its difference with an inverted candlestick. Read on to learn about the shooting star.

Definition: Shooting Star Candlestick

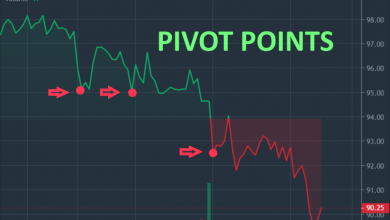

A shooting star is a bearish pattern used by traders in analysing the market. The candle pattern falls into the ‘hammer’ group. The shooting star single pattern formation happens after an upward movement in price. It begins when the market opens, and the price rises before the market closes.

How To Identify a Shooting Star Pattern?

A shooting star stands out thanks to the small body and super long upper candlewick and a tiny lower wick. Here are some characteristics of a candlestick shooting star.

- It must be bullish or bearish; it doesn’t matter which it is.

- The body of the shooting star must be found on the lower part of the candlewick.

- The lower wick is either absent or very small.

What’s the Meaning of a Shooting Star Candlestick?

When a shooting star forms it means there is a possibility of a downside bearish change in prices. The longer upper body of the candlewick shows that buyers have lost positions. The prices drop and the shooting star candle gaps down and moves to a lower volume on the chart, confirming the price change. It also shows that prices will keep dropping.

Strategies To Improve the Profitability of a Shooting Star Pattern

Even though shooting star patterns are highly reliable, they don’t work perfectly on their own. They yield better results when used with other filters and conditions to avoid getting a false signal. Here are some of the successful cost filters that can be used to filter out bad trades.

Seasonality

A frequently overlooked strategy of improving trading is seasonality which plays a crucial role in trading. You can use any of the following as filters:

- Time of day- forex markets trade differently depending on the time of day, so it’s important to study the market to identify the opening and closing time and the most lucrative time to buy or sell securities.

- Day of the week- some days are rather slow, including weekends, as most traders have already made their profits and have taken some time to rest. The day a market opens is usually the best day to trade but generally, knowing these tendencies comes in handy.

- Day of the month- if used correctly, this strategy helps a great deal; we recommend that a trader divides the month into 2 or 3 parts and pattern fares each.

- Month- some markets have a monthly seasonal tendency. For instance, in the oil market, prices increase as winter approaches and decrease in the warmer seasons which could affect the shooting star pattern.

Volatility

The impact of high or low volatility on the shooting star depends on the timeframe and the type of market itself. One way to watch the level of volatility is to watch the ranges of candlewicks. Long wicks and long bodies indicate a highly volatile market. You can also measure volatility using the true range indicator, which indicates the average volatility.

Shooting Star vs. Inverted Hammer Candlesticks

The two candlesticks are very similar in that both are reversal patterns but the latter hammer indicates a positive change, while the former signals a positive reversal.

Key Takeaways

- If the price rises after a shooting star pattern, it indicates a false signal, or that it’s marking a potential resistance around the price.

- Shooting star and inverted hammer are different in that one indicates a positive movement on the chart while the other indicates a negative movement.

- Traders cannot rely on the shooting star candlestick only to make decisions.

This is a candlestick pattern formed as a result of an increase in prices when they open and rise significantly then fall near the opening price.

Traders can use the shooting star after an uptrend, and there’s an indication of a bearish market. The indicator also comes in handy when a trader wants a short trade and is looking for an exit strategy.

A bearish candlestick pattern has a stronger formation than a bullish one since it has rejected all bull prices.