THE VWAP INDICATOR – ULTIMATE GUIDE AND STRATEGY.

Moving Averages are great, but the VWAP indicator is much better. Moving averages are the most basic and often used indicator, and they are one of the most important features of any trading platform. The Moving Average concept underpins a slew of fundamental and composite metrics.

But then, because the moving average simply calculates the average prices of different periods without accounting for trade volumes, attempts to enhance it led to the creation of Volume Weighted Average Price (VWAP) and other modifications.

Everything you need to know about the VWAP indicator is contained inside this article.

Contents

WHAT IS THE VWAP?

When averaging prices, VWAP (Volume Weighted Average Price) is one of the moving averages derived indicators that consider trading volumes. The volume-weighted average price is abbreviated VWAP. The Volume Weighted Average Price is just the cumulative average price divided by the volume.

The Volume Weighted Average Price (VWAP) is a metric for calculating the average value of a price that is weighted by volume. The VWAP indicator considers each timeframe’s trading volume. The bigger the quantity, the greater the importance of the period price on the end outcome.

FIGURING OUT VWAP

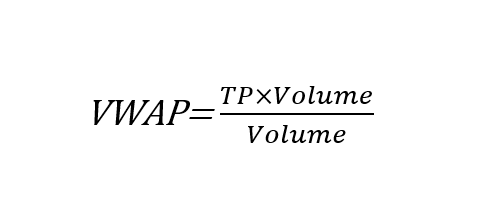

The formula is easy to remember:

Where TP stands for typical price

The TPV is calculated by multiplying the TP for each time by the volume. The next data points to the plot are generated by adding the following values to the previous ones in a running total of the TPV, also known as cumulative TPV. Finally, the VWAP is calculated by dividing the TPV by the cumulative volume utilized in the computation.

Follow these procedures to compute the VWAP on your own.

- Determine the stock’s average price throughout the first minutes of the trading day. To achieve this, multiply the low, high-, and nearby three. Multiply by both the volume of that period. You now have the PV value.

- Subtract PV from the volume for that period. The VWAP value will be calculated as a result of this. When looking at the VWAP value alone, it is not useful; it must be calculated as part of a series, as described below.

- Continue to add the PV value from each period to the previous values to maintain the VWAP value all through the day. Subtract the total volume up to that moment from the total volume. Create columns for cumulative PV and cumulative volume in a spreadsheet to make this simpler. VWAP is calculated by dividing both of these cumulative values by each other.

The free VWAP indicator takes care of all the arithmetic, leaving traders with only the lines, similar to how moving averages look on charts. Traders are strongly advised to grasp the math so they can make sense of what they’re seeing.

VWAP: ITS IMPORTANCE

Most experts believe the VWAP is more reflective of a genuine average price of the stock since it incorporates price and volume into its calculation. The VWAP is calculated separately from the stock’s closing price and has no impact on it.

The VWAP calculation is still considered a lagging indicator because it is dependent on past data, but that wouldn’t stop traders from utilizing it to define hourly resistance and support levels. Furthermore, because big traders utilize the VWAP as a reference for implementation activities, the VWAP price point is seen as having a significant influence on hourly price movement.

IMPLEMENTING THE VWAP

When trading in short-term timeframes, most expert traders believe that the VWAP is important and beneficial. Purchasing the very first closing price over VWAP as more of an entry and reselling at a specified point beyond it may be a basic intraday trading strategy employing the VWAP. But, far more often, trading techniques are a little more complicated than that.

The explanation for this is because many expert and amateur traders believe that the VWAP is used as a standard by a large number of big traders. Traders frequently feel that recognizing this trend should be part of their trading strategy.

As a consequence, a trader may employ VWAP as a limit for their trading. They may only go long when the price is less than VWAP and short when it is beyond VWAP. This criterion is premised on the idea that whenever the price is well below VWAP, benchmark-bending buyers are much more likely to generate support than when it becomes above it. This filter would be useful on days when the price movement was largely sideways.

Other trades, on the other hand, may choose the reverse. As a result, they would believe that purchasing a stock should only ever be done when the price is well above the VWAP, and short-selling should only ever be done when the price is well below it. This condition is predicated on the idea that reference monitors won’t be able to achieve the value they desire, therefore they’ll be compelled to push the stock farther into the day’s movement. This filter might be useful on days with a clear pattern.

Neither method tends to have a statistical edge when used on a significant number of deals. As a result, traders frequently use additional indicators in addition to VWAP. This enables them to use a more productive filter based on how they believe the day’s price movement will unfold.

APPLICATION OF THE VWAP INDICATOR

The VWAP is a technical indicator that may be used as a trend indicator to validate the present session’s price movements. Day traders can utilize the VWAP as a point of entry or create a stop-loss order because it can function as a resistance or support zone.

In general, as long as the share price moves below the VWAP line, it indicates that the price is trending downward. In contrast, the stock may be regarded to be on an upward trend as long as the price remains above the VWAP.

Whenever the price climbs through the volume-weighted average price line, this might be regarded as a buy signal using the VWAP as a pattern indicator. The VWAP should function as a support level for the share price once it rises above this line. In this scenario, the very same line may be used to determine the price level where a new direction is likely to occur. Investors might then utilize it to specify their stop-loss request, minimizing potential transaction deficits.

Now let’s look at how to use VWAP for both long and short-term trading.

HOW TO TRADE LONG-TERM WITH THE VWAP INDICATOR

The VMAP indicator has become one of the most prominent technical indicators among retail traders due to the growth of automated trading and the appeal of relatively brief methods. Is not very well for medium-and long-term trading techniques.

However, by validating support and resistance levels, the VMAP might indicate excellent opening and closing levels. If the VWAP has an exceptionally large volume, it will likely also become a useful resistance or support point. To determine the medium or long-term trend, I propose utilizing additional technical analysis techniques.

SHORT-TERM TRADING USING THE VWAP INDICATOR

The VWAP indicator’s settings should be adjusted first. Every day, Weekly, and Monthly VWAP are displayed by default. Those periods aren’t optimal for trading the VWAP because you’ll be utilizing it for quick trading.

RESTRICTIONS ON USING VWAP AS A TOOL

Because its results are dependent on price data from prior periods, VWAP is not a price prediction tool. As a result, the indication is utilized to validate a signal that has previously been obtained from other instruments. The following are the restrictions on trading with the VWAP:

The VWAP cannot be used to forecast the direction of the market. The index does not look for prior periods’ correlations.

The VWAP is a moderate- highly liquid market trend analyzer. You should avoid trading with this instrument around the time of news announcements.

One of the major issues with VWAP is the many variations of the indicator. When we examine the code, we can see that all versions have one thing in common: the price of each bar is weighted. In every other way, the indication versions differ.

In one scenario, the value is generated based on the cumulative data for the time given in the parameters. On the other, the calculation is performed for the chosen period, and each new phase begins with a fresh computation. As a result, the data from these different versions of indices will be different.

VWAP VS. MOVING VWAP: WHAT’S THE DIFFERENCE?

Short-term traders employ the VWAP indicator, which is an intraday-day indicator that lasts minutes or hours. Moving VWAP, on the other hand, is a better alternative for long-term traders since it provides signals for a longer length of time.

VWAP and VWAP in motion are both intriguing instruments. Traders employ VWAP indicators to gain a real-time sense of price reversal, which they may alter for a little time frame as well.

Traders that use other moving trend lines, such as the moving average or moving average approximations, find moving VWAP to be a valuable tool in their approach. Traders that pursue a price reversal approach also employ the moving VWAP. They use a bridging approach for this, which says that whenever a rapid average passes over a slow mean, it should be used to identify the direction of the trend. Moving VWAP is frequently utilized with packet channels amid price reversal trades to have a better knowledge of market movements.

VWAP is a fantastic tool that may be used in a variety of technical strategy situations. Traders combine it with other moving average techniques to determine the best market entrance and exit opportunities. It enables you to comprehend market interest, price movement, demand, and a potential trading point. Other indicators comparable to VWAP are also used by traders to build a good knowledge of market movements and to build their tactics on them.

VWAP INDICATOR INTERPRETATION

Traders may use VWAP to get important information about a market’s price action. It aids them in determining where even the momentum is located in a given period. Study the possibility of a trader who is dealt with a stock that has repeatedly struggled to push above the VWAP line owing to persistent price pressure. He may now want to determine the exact position at which the stock finally breaks well above the VWAP indicator level, or he risk being out on the losing end of market motion if he takes a short option.

Equities that sell below the VWAP line are referred to as “low” or “active funds,” and investors are advised to take a short position. Equity markets over the VWAP line, on the other hand, are labeled as “priced.”

FINAL THOUGHT

The VWAP appears to be a logical candidate for overlaying with various technical analysis ideas. Finally, the volume-weighted average price is used to determine the dominating pattern for the dominant session. Individual investors may find it useful to combine the VWAP with moving averages as well as other technical indicators to verify buy and sell recommendations.

The VWAP, on the other hand, is not faultless. Users must learn how to interpret the VWAP and how to combine it with other parts of fundamental analysis.