WHAT’S IN A NAME? – IRON CONDOR

Traders make the majority of their investments in the hope that the price would rise. They produce some in the hopes that the price would fall. However, it is always the case that the price does not respond much at all. Isn’t it great to be able to make money even when the markets aren’t moving? You certainly can. This is the allure of options and, more particularly, the iron condor approach.

Table of contents

A Brief Overview Of The Iron Condor

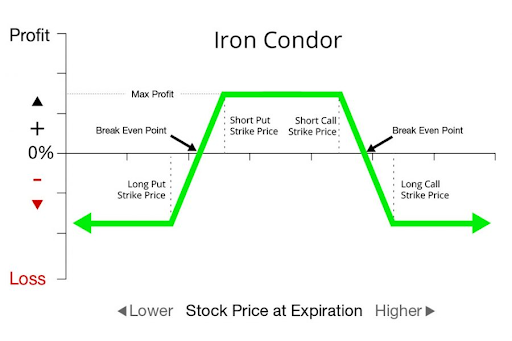

The Iron Condor is an options trading technique that employs two vertical spreads. The first is a call (which is a purchase option), and the second is a put (which is a sell option) (the option to sell). The profit and loss graph created by the iron condor is shaped like a condor. An iron condor appears vertically, again made up of four transactions (calls and puts) with the identical expiration date. It is because of this reason the shape of the graph is vertical. The profit/loss graph’s form resembles that of a big bird, which is how the iron condor got its name. (Of course, a condor is a big, predatory bird.)

In a sideways market with minimal volatility, an iron condor options strategy allows traders to benefit. The iron condor puts risk, alternative time differential selling, and predicted volatility on the trader’s behalf when combined with careful money management.

To create profit for the options trader, Iron Condor options employ both Call and Put options. The two counter-parties in a Call option deal are the Call Option writer and the Call Option buyer. On the trend of the security price, the two parties hold opposing viewpoints. Buyers are rest assured that via the call option, the underlying security’s price will increase, whereas the Call Option writer feels that the underlying security’s price will decrease.

The Iron Condor options strategy is a low-risk, low-reward option trading strategy that is a hybrid of the Bull Put and Bear Call spreads. The option trader sells a Put option and simultaneously buys a Put option with a lower strike price but the same expiry in a Bull Put spread. Both risk and return are restricted with this technique. The option trader is usually harmed when volatility rises.

The option trader feels the market is neutral or range-bound with this approach. This approach has a low risk and a high payoff. The maximum profit is realized when the stock price is between the strike prices of the Short Put and Short Call. The options trader benefits from time decay, but an increase in volatility damages the position. In an Iron Condor options strategy, two break-even points are generated.

Here is all you need to know about this strategy:

What is Iron Condor?

This options strategy should not scare you. It is understandable that at first, it sounds like a high school band from a video game. When you peel back the layers of the iron condor strategy, you’ll find that it’s essentially a mix of two pretty simple options strategies with a cool name.

A perfect combination of the out-of-the-money (OTM) short put spread (bullish strategy) with an OTM short call spread (bearish strategy) with options that all expire on the same date, delivers the iron condor. The success of the iron condor is contingent on the market staying inside a certain price range. For the iron condor options strategy, here is where strike selection comes into play.

But, for the two spreads, which of them are the best strike prices to use? It may definitely take some time to become used to the iron condor strike choices. You could choose prices at random, or you could apply some Goldilocks knowledge and some trader math to come up with probable strike prices for your iron condor options strategy. This doesn’t guarantee a good transaction, but it will provide you with a reasonable foundation to work with.

Long and Short Condors

When utilizing the iron condor method, a trader might take one of two positions. The approach employs a balanced purchasing and selling of the calls and puts involved in both situations. With long and short puts and calls, a trader effectively covers both sides of the underlying asset of the option. He hedges all of his positions by purchasing and selling an equal number of out-of-the-money calls and puts, each in the opposite direction.

Long Condor Strategy

When a trader predicts minimal volatility in the underlying asset, the long condor approach (butterfly strategy) is one of the best strategies that is utilized.

On the call option portion, the trader makes use of the bear call spread. This involves selling short a lower strike price call while buying a higher strike price call. On the put side, the trader utilizes a bull put spread, which involves purchasing a lower strike price put and selling a higher strike price put. It is, however, important to know that the call option together with the put option strike prices are both out of the money above the base security’s price, while the put option strike prices are out of the money below the basic security or portfolio.

Short Condor Strategy

When a trader anticipates substantial volatility in the underlying asset, the short condor approach is employed.

The opposite of the long condor is the short condor. The trader employs a bull call spread and a bear put spread, in which he sells a higher strike call option and buys a lower strike call option, as well as selling a lower strike put option and purchasing a higher strike put option. The call option together with the put option strike prices is both out of the money above the base security’s price, while the put option strike prices are out of the money below the basic security all options should have the same expiration date, regardless of whether the condor strategy is long or short.

How to Get Off the Ground

Iron condors appear to be difficult to understand and master, yet they are a terrific method to produce regular gains. Iron condors are used solely by some of the most lucrative traders. What is an iron condor, exactly? There are two perspectives on this. At outer strikes, it first appears as a pair of strangles, one long and one short. It may also be imagined as two credit spreads: a call credit spread well above the market as well as a put credit spread below the market. This is the root of the iron condor’s name- “wings.” These can be put anywhere in the market, but the precise definition requires successive strike prices on the same expiry month.

A credit spread is simply a method for selling options. Investors can profit from the time premium and implied volatility that comes with options by selling them. Buying a far out-of-the-money (OTM) option and selling a closer, more costly option creates the credit spread. This produces the credit, with the expectation that both alternatives will expire worthlessly and you will be able to retain it. You keep the whole credit if the underlying does not cross over the strike price of the closer option.

Iron Condor Money Management

Money management is crucial in trading, but it is more essential with Iron Condors. With so many moving elements, this method inevitably necessitates more changes. In times of market volatility, It is advisable to utilize one’s own set of adjustment rules and a really strong sense of discipline to adhere to them.

It’s advisable to start your Iron Condor position anywhere between 30 and 40 days before expiration. This will maximize the options’ time decay function while still allowing you to move far away from the market using premiums. Anything shorter than 30 days drives you to come dangerously close to the current market pricing.

Of course, the exact timing is not important, but it is advised. Different market situations will result in different possibilities, and you must weigh the risks and benefits. You can receive larger premiums and so enhance your monthly income if you get into the position early. However, it is a popular saying that the more time you give the market, the greater the risk that it may move against you, correct? In this case, prior experience is quite beneficial.

Choosing The Right iron condor Strikes

Probabilities are your best buddy; I’ve learned through the years. Knowing how likely it is that the market will move to a certain price will help you decide whether or not the transaction is worth risking your money on. And it’s because of these possibilities that I’m able to stay successful in the long run.

When it comes to Iron Condors, some distinct fundamental statistics should be employed to determine if strike prices are close enough out of the money to be safe. We’ve all seen the traditional bell-shaped curve in many sectors, and it may also be applied to the stock market.

Profit and Loss with the Iron Condor

A trader hopes for a small price fluctuation, with iron condor. Should all the options be out-of-the-money (OTM) when the expiry date approaches, the options are useless, and the trader can keep what remains after subtracting all commissions from the net premiums earned when taking on the four option positions. This will not occur in every transaction; in most iron condors, at least one of the options will be at-the-money or in-the-money.

When the price of the underlying securities is above the strike price of the long call option or below the strike price of the long put option at expiration, the maximum possible loss with a long iron condor occurs.

Often, a trader should terminate a position early and sacrifice part of the profit potential. This is especially true when the underlying security is volatile and the trading window moves around a lot. Because risk management is so important in this approach, it is best employed by experienced traders.

When the price of the underlying securities falls below the strike price of the short put option or rises above the strike price of the short call option, the short iron condor strategy makes the most money. Simply defined, the greatest possible loss is the debit incurred while placing the four option positions.

In Summary:

A long condor strategy aims to maintain the trading range (of the option’s underlying security) fairly tight; the goal of a short condor strategy is to have significant volatility enough to place one of the short options in the money.

As explained in the article, the body of the iron condor is made up of short (inner) positions, while the wings are made up of long (outer) positions; the iron part of the term stems from the fact that both call and put options are employed.

When all options expire with positions staying out-of-the-money, a long condor makes the most money; a short condor makes the most money when either the short put or short call option is in the money.

A final thought on Iron Condor

One of the greatest methods for an option trader to profit on a minor change in the price of an underlying asset is to use the iron condor option strategy. Many traders feel that to earn, a substantial move higher or downward is required. However, as you can see from the preceding method, traders may make a lot of money when the asset’s price is non-directional. The structure of this technique may appear convoluted at first, which is why it is only employed by experienced traders, but don’t let that deter you from learning more about this effective trading method.