How to Earn with End of Day Trading?

What is end of day trading?

Some traders prefer executing deals at the end of trading day. Why? New information appears, the closing price is determined, and the strategy for the next trading day can be figured out, as well. Let’s find out what else makes the end of day forex trading strategy so great for profit raising.

To start with, we should define what is day trading. Those are the hours during which all buy and sell transactions are executed. Exchanges have small time periods before the start of trading or after they close, when you can place an order to sell or purchase shares. The period after the close is called the postmarket. End of day trading means opening and closing positions before the postmarket begins (some trades are closing during this short period, if necessary).

Table of contents

Why is end of day swing trading so popular?

Trading within the day is the only way to avoid additional payments for holding positions (and in the foreign exchange market – swaps) – they must be closed before the end of the trading day on the exchange. That disciplines and calls for a more responsible approach to planning deals, because they should be closed within a short time frame.

Many intraday traders follow certain rules to limit losses:

- Invest what they can afford to lose. Intraday trading carries more risk than investing in stocks, and an unexpected price movement can wipe out their entire investment in a matter of minutes.

- Choose stocks with high liquidity. Traders who trade intraday must settle their positions at the end of the trading session.

- Trade with only two or three assets at a time because it’s imperative to closely monitor stock movements not to miss important end of day trading signals.

How does it work?

During the post-market period, an auction is held to determine the price at which the trading day will be closed. Counter orders are reduced and executed at this price, subject to the following conditions:

- At or above the closing price – limit buy orders;

- At or below the closing price – for sale;

- Market orders – at the closing price (actual).

Stock market end of day trading means opening positions by the finish of the main trading session and closing them before or during the postmarket. In the latter case, they are executed after the closing price is fixed. ‘Limit to auction’ trades have a priority over similar ones submitted during the auction. The priority of market orders is determined in the same way.

Advantages of end of day trading

- “Pure” trading signals. By the end of a session, traders see a clear picture of what happened on the market. Such signals are more reliable and have a higher probability of actualizing.

- Less stress. There’s no need to watch the market all day long being worried about each insignificant price move. When you trade at the end of the day and focus on daily charts instead of short-term charts, you are less likely to give in to emotions and overtrading.

- More time. Since it takes a few hours only, end of day trading might be combined with a full-time job when a person gets experienced in market analysis.

How to choose and develop an end of day trading strategy?

It should be based on several criteria, particularly – trader’s personal preferences.

Analyze the market

To correctly predict price changes, you need to master the basics of fundamental and technical analysis. Some beginners are sure that it’s enough to know a few indicators, but practice shows that profitable end of day Forex trading is impossible without deep knowledge in both areas.

Fundamental analysis is based on the study of the global economic and political situation. The release of any important news can impact even a stable trend on the market and lead to a price reversal. It can be, for example, a Brexit’s announcement, or events like the expiration of the Palantir lock up.

A trader must be ready for this: be able to correctly interpret the significance, content and consequences of the news. The basic rule is not to trade when important news comes out. One of the best day trading strategies is to close the position before the news is released.

Mathematical indicator analysis is the use of a number of technical indicators that exist in the form of mini-programs, which will give the trader signals to start buying or selling. There are two groups of such indicators:

- Oscillators that indicate a possible trend reversal and work in a situation when the price does not have a pronounced direction.

- Trend indicators that follow the trend at the moment when it is already on the market.

Technical analysis involves using a price chart and is based on past market movements. A price chart is a visual representation of a certain figure or pattern on a price chart, which gives an understanding of how the price will change in the future. To determine price fluctuations, a trader should be able to read and understand indicators.

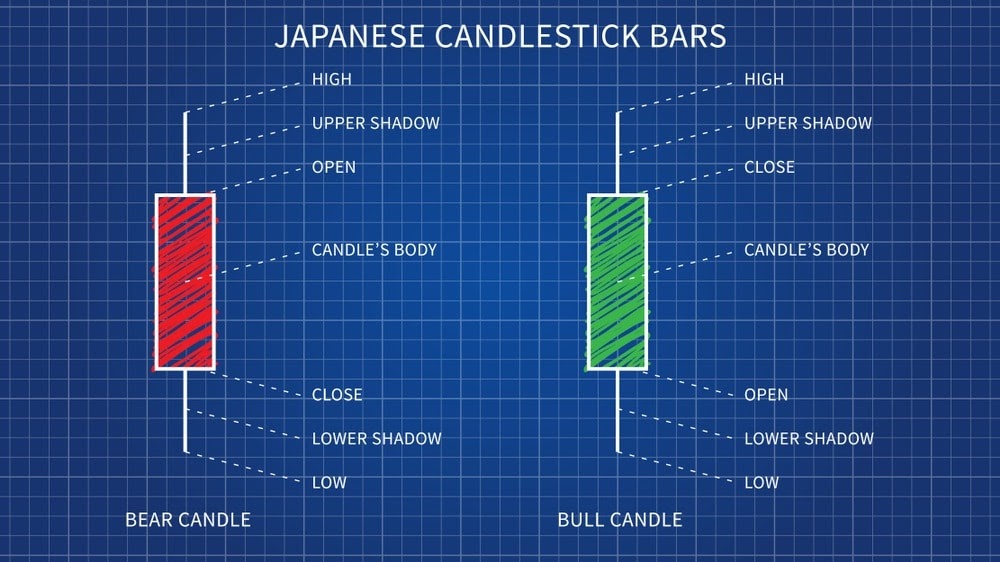

The best example of visuals for technical analysis is ‘Japanese candlesticks’. Those are graphical representations of price changes in the form of rectangles of a certain color depending on the type of candlestick. If the candlestick is green or white (bullish), the closing price is higher than the opening price, and if the candlestick is red or dark (bearish), it’s vice versa. In addition, experienced traders receive information about the market by the size of both the candle itself and its ‘wicks’.

There are two groups of patterns known – price reversal patterns and continuation patterns of the current period, each of which gives the trader certain information about the state of the market and allows developing day trading strategies that work.

Experts advise not to get carried away with a large number of indicators: analyze only a few, the most understandable and suitable ones. Experienced traders usually do not use more than two or three indicators at the same time.

Consider your experience

Before choosing a strategy, a person must assess his/her trading experience. As practice shows, beginners should not choose risky short-term strategies, since they will not have enough knowledge, experience, or the ability to analyze charts to close a deal with a profit. Don’t rush to come up with your own strategies – it is better to take advantage of the accumulated experience and study the existing approaches.

Plan your time

When opting for a day trading strategy, determine how many hours a day you are willing to devote to it. If you are too busy with the full-time job, day trading won’t be an easy option for additional income. It’s better to choose a medium-term or long-term strategy.

Psychology matters

Before choosing the best trading strategies, it is advisable to determine your psychological peculiarities, assess one’s strengths and weaknesses. If you are very consistent in trading and don’t get too upset by losses, opt for risk-weighted day trading strategies.

People who tend to make hasty decisions and don’t have patience can opt for scalping. However, it requires full-time dedication, focus and reaction. On the contrary, investors who hesitate in the face of changing market conditions should try something different from the end of day approach. They are recommended to hodl and open long-term positions.

Bottom Line

If you have gained some basic experience and want to figure out the best day trading strategy, consider performing transactions by the end of the main session. It comes with a bunch of advantages, such as having more free time, reduced stress level and more reliability of trading signals. This approach proves to be more efficient than day trading if we compare profit/effort ratio, so don’t overlook this strategy – it’s one of the most optimal variants on Forex and other markets.