Nifty Elliott Wave Analysis for Trading 2021

Elliott wave is one of the most popular theories of technical analysis. RN Elliott invented it after analysis of data close to 75 years. This theory is globally accepted because it explains the repetitive cycles of the stock market. Elliot wave cycles are directly dependent on external influences and the emotional state of investors at the time of trading.

Elliott wave clearly describes market psychology as it manifests in waves. The reason why Elliott waves were readily accepted is that prices change between impulsive phases and corrective phases. These phases are responsible for putting market trends in place and retracing back the steps of these trends. Simply put, impulses have five low-degree waves, and corrections have three low-degree waves.

Elliott patterns are always constant. The 5/3 waves represent a complete cycle. Various patterns like triangles, zigzag corrections, and expanded flats are formed by these waves.

The Elliott theory is prevalent among traders because it allows them to identify specific points where the stock market is most likely to reverse.

Simply put, RN Elliott established a method that allows traders to capture tops and bottoms.

Table of contents

Here are a few basic concepts used in Elliott Wave Analysis theory.

- Every action is always followed by a reaction

- Five impulsive waves are moving in the direction of the trend followed by three corrective waves or known as the ABC cycle. To shorten it, we can use 5-3 Move term

- 5-3 move is considered as one cycle

- This 5-3 move or one cycle then becomes part of an even bigger 5-3 move

- This pattern of the move will be constant, but the time period can change

Types of Elliott Wave Based on Price Trends

Besides Elliott’s basic concepts, we have to understand two types of Elliott wave based on the price trends. The first wave is called the Impulsive Wave. This wave happens when you see a price movement in one direction during a certain period, what you see is an impulse wave. This wave is a picture of an imbalance in market sentiment which ultimately directs prices in one direction only. If the line looks up, it means that the market situation and conditions are also feeling euphoric, so the price is pushed up. And vice versa, if you see a downward line, traders are in a state of panic, trying to keep the price down until it continues to decline.

The second type is the Corrective Wave which is in question is a situation where the equilibrium point is reached again after the price imbalance during the period of the corrected impulse wave. In this type of wave, professionals play a role and must be observed in the speed of price movements. The faster you see the price moving up, the higher the price will have the potential for a downward correction. On the other hand, if the price declines too quickly, then the potential for upward correction will open.

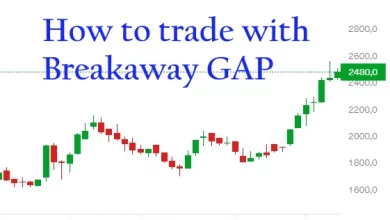

Reading Nifty Elliott Wave Chart Analysis for 2021

The chart of the nifty Elliott Wave is quite different from the candlestick chart. In complete minutes candle shows bullish and bearish to show important levels during market hours. While the nifty Elliott Wave shown in the chart supports waves to support our data to take our strategy or to predict risk or to do trade, Elliott Wave time bar analysis also shows the ABC cycle that gives an idea of which market move is possible or may be completed. In addition, the ABC cycle or correction waves have 21 types and are categorized into 3 formations. They are zig-zag formation, flat formation, and triangle formation we should understand.

Understanding the complete minute candle in the nifty Elliott Wave enables us to see what is updated in the market. For example, an inner wave consists of five sub-waves, and a set of these sub-waves will form a similar pattern. The five sub-waves have included two corrective waves and three impulse waves. Impulse waves follow the same direction, either increasing or decreasing depending on the major wave, and conversely corrective waves move in the opposite direction. Not to mention, they can meet each other and make break-even points.

The COVID-19 crisis is far from over, optimism abounds in stock markets worldwide despite the newly developed vaccines. Some investors have never been fond of buying at new record highs. Instead of joining the bulls near 13 500, we can see where in the big Elliott Wave prediction does the current surge fit. In June 2021, Nifty prediction continued to touch lifetime high levels. But on the other side Bank Nifty is still quite far away from the new highs.

The Bank Nifty is currently below its lifetime high of 37708 levels that means underperformance from its side. But it is believed to see if in the next few sessions Bank Nifty will start to take a lead again. The main reason is taken from the daily chart of Bank Nifty shows that the overall structure is positive. Not to mention from the last 2 sessions where sideways action is ongoing. The action has managed to keep the state above the crucial 9 days EMA and might be completed with success. It indicates that the strength of the Nifty Bank remains on the upside.

In addition, prices are moving on the upside in the form of wave c or alternative wave iii on daily charts. It can be understood from the time bar chart that the Bank Nifty trend keeps its state bullish. Based on the analysis, we can find that Elliott Wave theory performs high accuracy trade to support your trading strategy and nifty forecast whether provided in the short term as well as in the long term to help in the progress of trading strategies.