Highest Share Price in India. 10 Biggest Price Stocks

Many investors are always looking for a way to diversify their income streams. The stock market has recently become very popular as one of the ways to earn income for many people. As an investor, Your income can double within a year if you know how to practice trading in the stock markets. There are many things that people look into while trading in the stock market. Before investing, critical information such as market price and stock rating are things to consider.

For instance, Fluctuating share market prices have been known to be a common occurrence. The volatility of stock market prices can create quick profits. At the same time, it poses a high risk to the investor if things don’t go as planned during trading. It is better to do your due diligence and find companies that have. Have a high market price in terms of shares. This means your profit would be yielded. Much faster, even if not now, but soon.

A lot of the shares in the Indian market transacted a sharp rise that is below ₹1000. However, around 3500 firms enlisted on the Indian share Market have a price share Of less than ₹500 per share. The price share of a company does not depend on the company’s valuation. For example, a company with a price share of ₹2000 may be undervalued compared to its competition. At the same time, a company with a price share of.₹100 may be overvalued for trading.

It might be tricky to buy these kinds of stocks that are trading at. It is a very high market price. But it is very fascinating to watch and know what is happening. This article highlights ten companies in India with the highest market price in shares. These are also one of the most costly stocks. You can choose to invest in the India market Today.

Top ten companies.With the highest price share In India

There are more than 7000 firms listed in the Indian Exchange market. Additionally, more than 300 companies are trading above ₹1000 today. As of August 2021, the highest price share in India was trading above ₹75,000 per share.

Enlisted below are ten companies with the highest price share in the Indian stock market. We have also highlighted extra details like the industries they belong to, Samco stock ratings. And their current PE ratio and the cap market price These companies are some of the best and most prominent companies you can choose to invest your money in. The large-cap companies have a very High market price in terms of stock.

- Madras Rubber Factory (MRF)

MRF is one of the leading tyre manufacturers in India. It is one of the companies with the most expensive share price in India. It has a cap market price of 31,325.84 Cr. They manufacture a wide range of tyres as they fall under the tyre and rubber product industry. MRF specializes in bike tyres, bus, and car tires and is one of the best. Tire companies.

MRF has a record high stock price of ₹98,599, and in 2012 they crossed over the 10,000 rupees Mark in March of 2012. The management of MRF never split stock or issued stock. That is why they have High stock prices in India. MRF Has a market capitalization of 31,325.84 rupees Cr.as of December 2021. MRF stock now trades with a PE of 25.95. With a return of negative 6.22%. In their last year, MRF’s current price share was 73,880 rupees and had a stock rating of 1 out of 5 stars.

- Honeywell Automation India.

As a Fortune 100 company, Honeywell was ranked number 92 in 2019. Honeywell is the leading supplier of integrated automated software solutions. They have an extensive profile in environmental and combustion products. They also do engineering services in the field of automation. Honeywell trades on both the National Stock Exchange and the Bombay Stock Exchange. In one year, Honeywell generated a return of more than 24.81%. They are now trading at a PE of 78.79 as of December 2021. Honeywell is among the companies with the most expensive share price in India. With a cap market of 33,930.79 Cr, Honeywell’s current price share is 38,530 rupees. Honeywell has a stock rating of 2 out of 5 stars.

- Shree Cement.

Based in Kolkata, Shree Cement is a well-known cement manufacturer. Founded in Beawar Ajmer. Shree Cement became one of the biggest cement manufacturers in northern India. They produce and sell Power under Shree Power or Shree mega power. Currently, they are trading at a PE of 36.18 with returns of 4.72% in the last year. With a capped market of 94,855.56 Cr, Shree Cement’s current price share is 25,860 rupees, with a stock rating of 2 out of 5 stars.

- Page Industries

Page Industries is one of the top textile manufacturers in India. It is a leading retailer of underwear and socks. The most common brand of Page Industries is known as Jockey. Their stock Has become Very costly in the last couple of years, with returns of over 192.40%. Page industries is trading shares at a PE off.96.7. With a cap market of 42,652.71 Cr, Page Industries has generated returns of more than 51%. This company is among those with the most expensive share price in India. Page industries current price share is 38,368rupees. Page Industries has a stock rating of 3 out of 5 stars

- 3M India

3M India Limited is The Subordinate company of 3M USA. 3M USA has about 75% Equity Shares in the company. They have an expanded portfolio of different products like healthcare, cleaning, and dental cement. With a cap market of 28,158.71 Cr, 3M stock trades at a PE Of 133.32. With a return of 12.27%. Within the last year. 3M India’s current price share is 19,320 rupees.3m India has a stock rating of 2 out of 5 stars

- Nestle India.

As an investor, one of the most prominent companies to watch out for is Nestle India. This company has a wide range of products in the food sector, such as chocolate, milk, confectionery, And beverages. Nestle has the highest market price in the Indian share market. With products such as Maggi, KitKat, and Nescafe, it is a subsidiary of the Swiss company nestle. In the last year. Nestle has had returns of 10.65%. A cap market of 188,041.50 Cr is now trading with a PE of 83.89. Nestle India’s current price share is 19,320 rupees. Nestle India has a stock rating of 5 out of 5 stars.

- Bosch

Bosch is an electronics and engineering German-based company. In recent years. Bosch Popularity Has increased due to the high market price of their shares. Bosch is in the automobile and ancillary industry. With a capped market of 49,080.96, Cr Bosch now trades with a PE of 35.02. it has returns of 27.47%. Within the last year Bosch’s current price share is 16,452 rupees and has a stock rating of 2 out of 5 stars.

- Proctor and Gamble

P&G is known as one of the most famous FMCG companies in India and worldwide. Procter and Gamble Is a consumer hygiene and health care firm. They are popularly known for their products, such as Duracell Gillette and Pampers, among others. It has a cap market of 49,575 Cr. P&G Is now trading with a PE of 80.45 And has returns of 38.29%. Within the last year, P&G’s current price share is 15,130 rupees. It has a stock rating of 4 out of 5 stars.

- Bajaj Finserv

Bajaj Finserv is a subsidiary company of Bajaj Holdings and Investments. Bajaj Finserv is a financial company that specializes in lending, wealth management, insurance, and asset management. With a cap market of 282,598 Cr, it has given more than 92.23% of returns within the last year. Now trading with a PE of 66.90. Bajaj Finserve’s market price is 17,501 rupees. Bajaj Finserv has a stock rating of 3 out of 5 stars.

- Bombay Oxygen Limited.

Bombay Oxygen was founded in 1960. Their core business is manufacturing and distributing industrial gasses. This company Has the most significant financial investment in terms of mutual funds, financial assets, And shares. Bombay oxygen-limited has a cap market of 206.84 Cr. With a return of 7.59% within the last year, they now trade with a PE of 2.88. Bombay oxygen current price share is 13,414 rupees and has a stock rating of 0.5 out of 5 stars

Other companies in India with a skyrocketing market price in their shares Include National Standard, Polson, Unichem Labs, and Maruti Suzuki India.

Summary

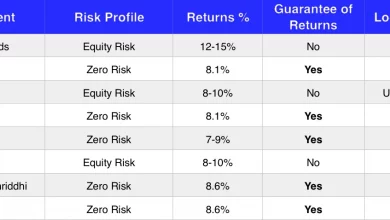

In the table below, We have enlisted Ten companies with the highest market price in India as of December 2021 in India alongside their popular share value.

| Company. | Industry category. | Current price share. | Returns over 1 year. |

| MRF | tyres | 73,880 | -6..22% |

| Honeywell, India. | Consumer electronics | 38,530 | 24.81% |

| Shree Cement. | construction | 25,860 | 4.72% |

| Page Industries | textile | 38,368 | 182.40% |

| 3m India | Various sectors | 19,320 | 10.65% |

| Nestle India | food | 19,320 | 10.65% |

| Bosch | Auto ancillary | 16,452 | 27.47% |

| P&G | FMCG | 15,130 | 38.29% |

| Bajaj Finserv | investment | 17,501 | 92.23% |

| Bombay Oxygen Ltd | Investment | 13,414 | 27.59% |

Conclusion

It is essential to invest in a company with the highest market price and good stock ratings in the current market. This means that you will have high returns guaranteed. Stock prices are very dynamic and can change anytime, so it is Safe to analyze options critically and do your research before selecting a company to invest in. Concerning portfolios, it is advisable to choose a mutual fund very keenly. Do this so that your portfolio is strong enough, and soon it will give you a considerable profit. This may be a stable source of income for you as an investor.

Frequently Asked Questions

Which Indian company has the highest market price in shares?

MRF takes the lead as the firm that has very high share prices. It is also the largest tyre manufacturer

Do high-priced stocks fluctuate?

They are not so volatile. High prices are quite stable and have very minimal speculation. High-priced stocks attract less trading volume because most investors do not have the capacity to trade high volumes at high prices.