Xmaster Formula Indicator Forex No Repaint ⚡ (2022 for MT4)

The Xmaster formula indicator is popular among traders due to its ability to demonstrate both the direction and strength of a trend. The indicator is also super easy to use and understand, and its accuracy in predicting trends remains unmatched. In this article, we will discuss what you need to learn about the Xmaster formula indicator. Read on to find out.

If you are just here to download Xmaster Formula MT4 Forex Indicator zip – click the link

Contents

How Xmaster Formula Indicator Works

The indicator appears in a different window beside the trading chart. It displays red and green oscillators. The green dots are always thinner than the red ones.

The primary signal is yellow, which indicates when to buy or sell.

The green oscillator indicates that the currency price is increasing while red reveals a decrease in price.

There are also arrows on the chart indicating signals for market entry, that is, when to buy or sell. The upward yellow arrow appears when the red lines change to green and vice versa.

Even though this indicator is reliable, it should not be the only indicator a trader uses when making a purchase or sell decision. Sometimes the signal takes time to appear, which means you can lose money as timing is everything in FX trading. However, if you are patient, the indicator will work just fine.

Buy Indicator

The line changes from red to green, followed by an upward arrow. You can start trading once the conditions have been met, and you can stop trading once the bearish trend appears.

Sell Signals

The dots turn red, followed by a downward arrow indicating a bearish trend. Start selling once both conditions have been fulfilled. Stop trading and take the profits when the line turns greens.

Xmaster Formula Indicator Forex No Repaint Free Download and Installation

To download Xmaster formula forex no repaint indicator for MT4, you can find it on google by searching the keyword Xmaster formula free download. Explore the several sites that will appear until you find a download link.

To install the indicator after a successful download, follow the following steps.

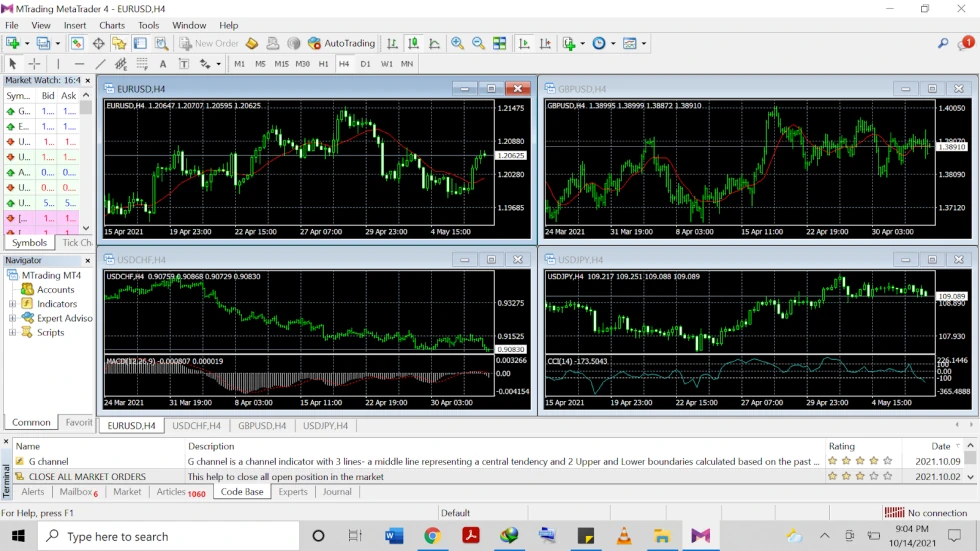

- Launch the MT4 platform. You should be able to see something similar to this screenshot.

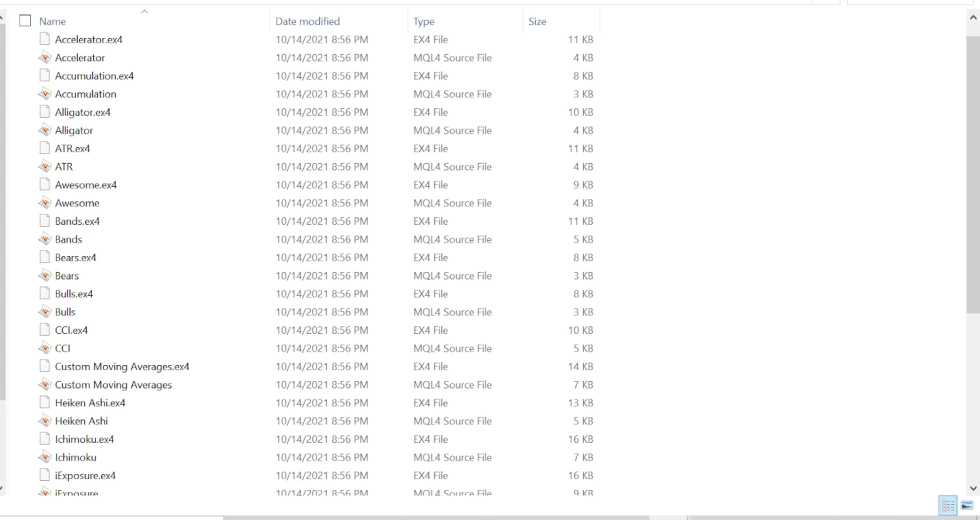

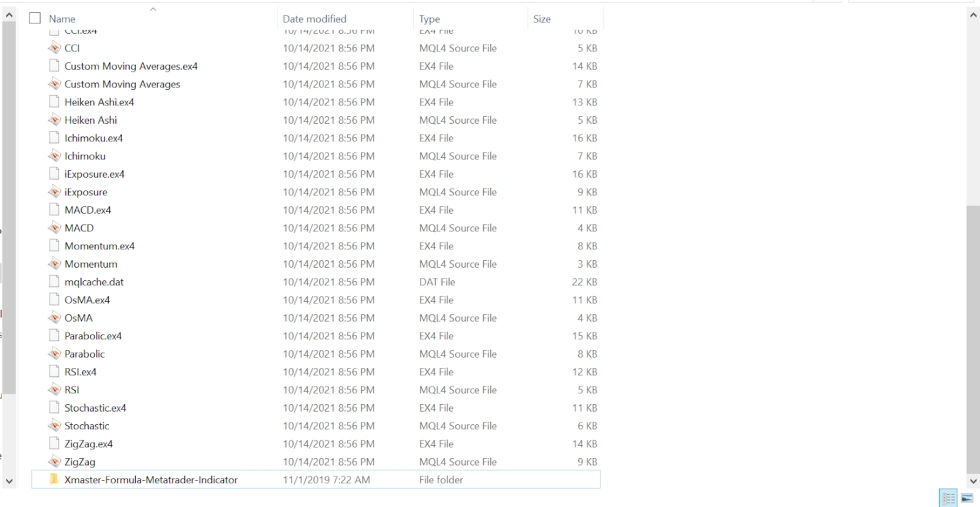

- Click on File and select the open data folder, then MQL4, and finally choose an indicator.

- To make things easy, copy and paste the Xmaster installation file you had downloaded into the indicator folder. It will appear as shown below.

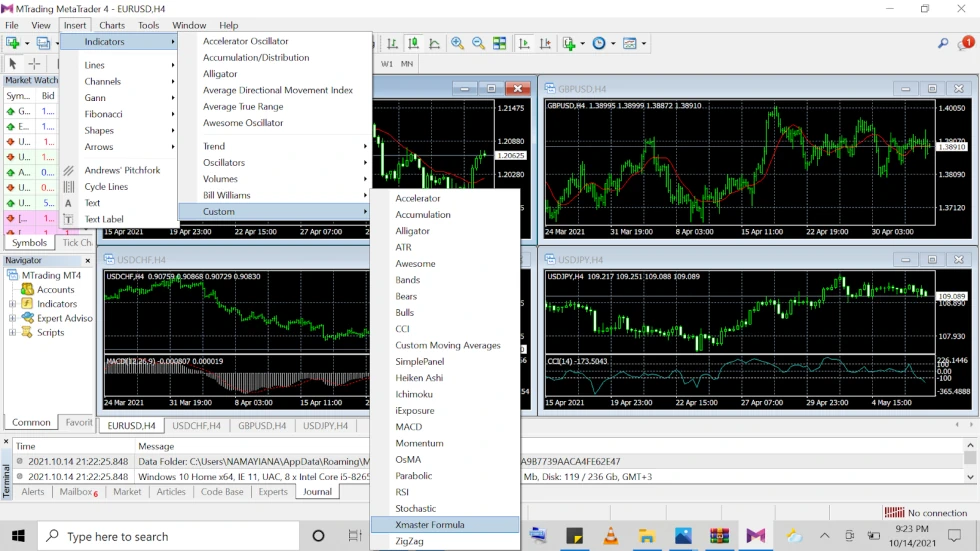

- Close the platform and restart it again. The indicator should automatically be updated in the customer indicator section, as shown in the screenshot.

- If the indicator does not update, refresh the navigator window by highlighting the indicator tab.

How to Attach and Detach the Xmaster Indicator from the Chart

Attach the indicator to the MT4 platform to start receiving trading signals. You don’t need to be tech-savvy to link the chart. Simply go to the custom indicator menu, find the navigator window’s shortcut indicator, and highlight it. Scroll down and double-click on the Xmaster shortcut to adjust the settings and attach the chart.

To detach the indicator from your chart, drag the pointer on the indicator line. Right-click on the dotted line and an indicator line should appear. Delete the indicator options, then right-click anywhere around the middle of the graph to reveal a selection box. Choose the list indicators and highlight the Xmaster to delete.

Pros and Cons of Xmaster Formula Forex No Repaint Indicator for MT4

The trend indicator comes with a bunch of pros and cons we cannot exhaust in one day. Take a look.

Advantages

- It’s effortless to use and suitable for beginners.

- High signal accuracy of more than 70%.

- Suitable for intraday traders but can also be used by swing traders.

- It’s available for use on all currency pairs.

Disadvantages

- Once the signal appears, it takes a long while to reappear.

- There is a 30% chance of fake and inaccurate signals to occur.

- It requires very high patience if used alone.

Bottomline

Xmaster formula indicator is a worthy addition to FX trading and is suitable for market conditions like high volatility and exotic currency pairs. It can enhance a trader’s experience and will increase the chances of success. However, remember winning also entails proper management of money, mastery of emotions, and discipline. Keep your expectations in check, as the analysis tool does not guarantee 100% accuracy. The indicator is subject to false signals occasionally, meaning you need to use other analysis tools and analyze market trends yourself. You can constantly develop your analysis around the Xmaster indicator.