Carry Trade: Basic Insights You Should Know

What is carry trade?

When it comes to crypto currency, carry trade is about borrowing assets at lower APYs and providing them as liquidity for higher interest rates. Since the difference in rates remains the most important thing in carry trading, this is a long-term strategy. It is not suitable for intraday and scalpers. All in all, the carry trade definition is ‘buy cheaper, sell higher’.

Table of contents

How does it work?

First, a trader finds the difference in rates that suits him. As a rule, carry trade involves different currencies, so investors compare the rates of different crypto exchanges in order to choose the optimal pair. With DeFi tokens around, there are hundreds of great carry trade examples around.

In addition to the difference in rates, it’s important to study the history of the selected currencies. They should be trustworthy and more or less predictable.

Tips for carry trade

- It is very important to keep track of news concerning the asset and the industry. If you plan to enter an asset after revising the rate, you need to do it at the beginning, not at the end of the upward movement.

- Make sure that the investment currency grows. Also, you can enter during the sideways trend – low volatility is not a hindrance to earnings. This, of course, is one of the undoubted advantages of the carry trade.

- If the investment currency is in a state of permanent decline, you should not try this strategy, even if you are strongly attracted by tasty APYs. The fall in price will gobble up all your profits.

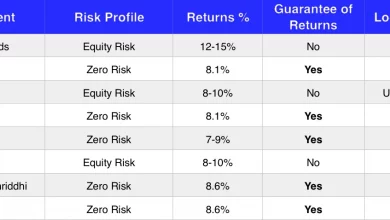

- Carry trade is not suitable for investors with a small start-up capital. The yield on the carry trade is unlikely to exceed 8%, not to mention the commissions or interest.

- If you see asset price nosediving, try to figure out how deep the drawdown will be and whether it will eat up the estimated income. It is also important to determine if a downtrend has begun, turning into a long-term movement, or if it is a correction and the price will return to a bullish trend.

How much can you earn?

It’s hard to make any predictions with cryptocurrency. This is not a bank deposit in native currency at a fixed interest rate. In order to estimate the income, you can use a carry trade calculator. For manual estimations, you need to consider the following factors:

- The difference in the rates of funding and investment cryptocurrencies.

- The prevailing trend on the market.

- Select suitable assets and calculate the level of income for them.

Risks of the сarry trade strategy

- Change in interest rates. Everyone knows that the interest rate in all markets is a dynamic indicator that changes depending on the macroeconomic situation. If the interest rate gets sharply raised, asset prices will respond with a decline, the strength of which depends on the duration. If a carry trader wants to sell cryptocurrency during serious price fluctuations, he can lose money.

- Currency risks. Fluctuations in some currency pairs are also quite significant, especially in the crypto industry. Hedging instruments are used to mitigate currency risks (futures and options).

- Default risks. Of course, the most reliable instruments are selected for this strategy, however, the probability of currency default cannot be completely ruled out.

- Other expenses. A carry trader should be well aware of commissions and other expenses he will face for guaranteeing positive carry trade balance.

Pros and cons of the carry trade approach

It is naive to think that this strategy is popular because it does not carry any risks. This trading method also has both advantages and disadvantages.

| Pros | Cons |

| No need to monitor the market 24/7. This strategy works well in the long term. Carry trade is a great option for passive income. | It is not very profitable compared to other strategies. With fiat, it brings 7-8% profit per year, but with cryptocurrencies, it might be higher. |

| It’s equally suitable for fiat and cryptocurrencies. | The major carry trade risk is losing money if currency prices change suddenly. |

| It’s possible to trade with leverage and multiply earnings. | Commissions might change seriously, which will also impact the final profit. |

How to boost efficiency and carry trade profit?

- The main and most effective approach is diversification. Follow the example of seasoned investors and scatter investments over different currencies.

- Another way to reduce risks is to monitor news and events, both political and economic, that can cause sudden movements of the selected asset. For this purpose, you still have to do a little fundamental research, at least to understand market processes and the reasons for price movement.

- Also, if you want to minimize risks, give up leverage trading – it’s ten times riskier. Beginners should not opt for it.

- Constantly keep a solid deposit, at least $10k. Since the risks when working with Carry trade are relatively small (if you do not use leverage), its profitability will be at best 5% per month.

- Learn to work with large timeframes and keep patience. Corrective movements of a currency pair can bring losses for several days, or even weeks, it is necessary to distinguish such temporary rollbacks from a global trend reversal.

- Feel free to conduct fundamental analysis, be ready to constantly monitor the interest rate for carry trading and the likelihood of their changes.

- Carry trade is a long-term strategy primarily used by professional investors rather than private traders, but we can provide some guidance for our readers on how to use it.

Carry trade in the crypto market

Cryptocurrency market now has an immense capitalization and millions of dollars in daily turnover. This market has become such a convenient place for carry trade operations that they have a significant impact on the rates of leading currencies. However, there are certain conditions under which such operations can bring a significant profit to the trader.

First, it’s important to maintain high trading volumes, especially without using leverage. The initial deposit in crypto can be worth tens and hundreds of thousands of dollars. With leverage, you can start carry trade arbitrage with a thousand dollars, but the risks are increased many times over.

Possession of fundamental analysis skills. Since profitability here strongly depends on interest rates, you need to be able to monitor and predict them. You cannot rely on an automated trading algorithm in the case of carry trades. To monitor rates, you can use both a trading terminal window or your broker’s website, as well as specialized services.

Finally, a trader should have patience to wait out long periods of rate correction or the exchange rate of the currency itself. It works on large timeframes, when a pair reversal can occur in a few weeks or even months.

How to find a suitable carry currency pair?

The following algorithm will help you find an optimal variant for trading.

- Find a currency pair for which the optimal percentage difference on the platforms allowing users to borrow assets.

- Check the pair for a positive swap.

- Analyze the trend to understand whether the market direction will give you an opportunity to earn money. For example, if you have determined that a positive swap is observed with long positions, you need to look at large time intervals whether the pair will move up or, at worst, sideways, which is also acceptable.

- Find and analyze assets in which borrowed funds can be invested.

Bottom Line

Carry trade is a relatively new thing on the cryptocurrency market. It also bears high risks but can be more profitable than fiat currencies because interest rates for crypto and DeFi coins are more diverse. Traders who don’t have time to track the crypto market 24/7 are highly recommended to try this approach. However, it also requires some basic knowledge and the ability to pick reliable platforms.