India Introduces a 30% Cryptocurrency Tax

The “will they, won’t they” relationship between the Indian crypto community and regulators opened a new chapter this week with the India 30 cryptocurrency tax. One of the 2022 budget standout elements that the finance minister announced was a 30% tax on income from the transfer of virtual digital assets.

The move signifies another policy shift from the Indian government. The cryptocurrency tax in India may indicate that the government is now leaning towards legalization. The talk of a ban has been looming over the industry since the Supreme Court lifted a previous ban in March 2020.

What it Means for the Cryptocurrency Bill Currently in the Draft Stages

The question on most people’s minds is the implications of taxing an activity that is yet to be regulated. Since the SC Garg Committee issued its findings in 2019 and recommended banning crypto, many have waited with bated breath to find out what the government will do. The proposed cryptocurrency bill that has been in the draft stages for more than a year now threatens to issue an outright ban and include provisions for custodial sentences for people who violate its terms.

When asked about the taxation of an unregulated industry, Finance Minister Nirmala Sitharaman responded that she could not wait for regulation to tax people earning profits. According to the minister, the 30% cryptocurrency tax does not affect the bill. With various parties offering their input and public stakeholders being involved in the process, the shape of the bill cannot be determined at the moment.

A Step in the Right Direction

The Indian government has always taken a cautious approach to cryptocurrency and other DeFi elements. The RBI issued its first statement in 2013 warning people about cryptocurrencies. In 2017, the finance minister likened the industry to a Ponzi scheme, and the RBI banned crypto in 2018. Given the government’s hostility in the past, acceptance of revenue from the industry may suggest a rethinking of its perspectives.

Taxing the industry means moving away from likening it to a Ponzi scheme. It means the government recognizes the opportunities in the digital innovation seen in blockchain technology. The tax measures may hurt players in the short run, but they will offer the government more information on the industry size and the number of people likely to be affected if a ban were to be implemented.

Good News for Crypto Startups and NFT Creators

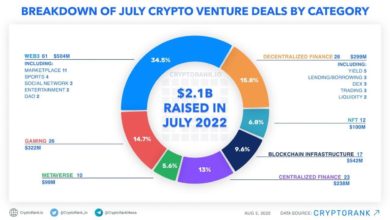

Approximately $22 billion was traded in the NFT industry in 2021. Industry data shows approximately 380 crypto startups in India, and funding increased by over 73% in 2021 compared to the previous years. The constant threat of bans has hampered the growth of the DeFi industry. Despite the impressive growth, there is room for more, and offering legitimacy to the industry helps.

Startups stand to gain by attracting new classes of investors who have avoided pumping their funds into an industry with a ban looming over its head. Crypto startups can now use their taxation status as proof of government recognition even without regulations.

The NFT industry has been termed “the digital gold rush,” and the impressive 2021 numbers demonstrate its potential. With the newfound legitimacy from the cryptocurrency tax in India, NFT creators can expand their audience and market their digital creations to new markets. People who may have avoided buying NFTs due to concerns about legitimacy may have their fears quelled by the government’s acknowledgement of the industry.

Negative Impact on Investors’ Returns

India’s 30% cryptocurrency tax may be seen as a deterrent to investors. Previously, the appeal to some investors may have been the untaxed nature of their crypto earnings. There may be fears that this will lead such investors to shy away from investing in cryptocurrency startups due to reduced returns.

While it may be a valid concern, the 30% rate falls within the normal range. Taxation rules for people making over 1.2 million Rupees annually set the rate at 30%. Most retail investors fall under this income category, meaning the crypto tax will only match with taxes from the other ventures on their portfolios.

In the absence of regulation, there is no indication that the Indian government has any monitoring measures to determine earnings from crypto accurately. Self-declaration will be the primary source of information, and this offers investors a sense of control over the taxes remitted to the government.

On the other hand, small-time retail investors are bound to feel the impact of the 30% tax. The World Bank Global Financial Inclusion Database puts India (40%) at the top of the list of countries with the most inactive bank accounts. India also has the 2nd highest percentage of unbanked people. Actions such as the 30% tax on all transfers of cryptocurrencies, tokens, and NFTs will push out such people. The middle class and poor people only trade in low volumes and will see the tax cause a significant dent in their earnings.

A Blow for Creators

On platforms such as Chingari (India’s Tik Tok competitor with its token on the Solana ecosystem), creators have spent their efforts growing their audiences and increasing their earnings. The 30% tax will see their earnings dented significantly and may even deter them from accepting payments in crypto.

As the NFT industry continues to grow, traditional creators such as artists, photographers, and musicians have managed to sell their creations on NFT trading platforms. This means additional revenue sources with global demand for local creators. Their income will reduce significantly when they remit 30% of every transaction.

The Bottomline

The introduction of India’s 30% cryptocurrency tax is a bittersweet moment. On the one hand, industry players will use their tax compliance status to demonstrate legitimacy and attract new classes of investors. This is also a step in the right direction for a government that has been planning on a crypto ban for a while.

On the other hand, creators and small-time crypto users will see their earnings be reduced by 30%, which may steer them away from using crypto. For some, such as NFT artists and Chingari creators, crypto is their primary income source, and losing it will mean loss of primary income.

It remains to be seen how the government will enforce the tax, given that decentralization makes it challenging to monitor transactions and determine the tax amount.