How much is the income tax on binary options in India?

How are Indian traders taxed when they trade binary options? Find out how to perform such trading and read about its legal status in India.

How much are the taxes for binary options trading? For Indian residents, taxation is organized the following way:

| Income TAX Slab | TAX Rates As Per New Regime |

| 0 – 2,50,00 ₹ | Nil |

| 2,50,001 – 5,00,000 ₹ | 5% |

| 5,00,001 – 7,50,000 ₹ | 12500 ₹ + 10% of total income ixceeding 5,00,000 ₹ |

| 7,50,001 – 10,00,000 ₹ | 37500 ₹ + 15% of total income ixceeding 7,50,000 ₹ |

| 10,00,001 – 12,50,000 ₹ | 75500 ₹ + 20% of total income ixceeding 10,00,000 ₹ |

| 12,50,001 – 15,00,000 ₹ | 125000 ₹ + 25% of total income ixceeding 12,50,000 ₹ |

| Above 15,00,001 ₹ | 187500 ₹ + 30% of total income ixceeding 15,00,000 ₹ |

More information on income taxes in India can be found on the website of the Indian Income Tax Department.

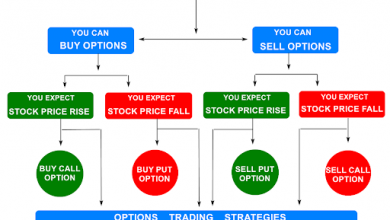

What is binary options trading?

Such a trading approach includes executing exchanges that permit you to benefit from value vacillations of different assets, including commodities, stocks, futures and currencies.

As a trader, you execute an exchange depending on whether you figure the cost of the asset will end above or under a particular cost by a particular time-frame, known as the lapse. This straightforward yes/no approach makes options trading relatively simple.

As the term “binary” suggests, there are just two potential results in this kind of trading. Either the cost of the asset goes over the anticipated cost, or it doesn’t. Hence, a trader either makes a great profit or losses the entire deposit. Some brokers offer from 60% to 90% profit, which sounds lucrative for traders.

Is binary trading legal in India?

You may see various replies regarding whether this type of trading is lawful in India. The truth is that binary options traders and brokers can’t legitimately be situated on Indian territory. However, Indian residents can in any case try their powers on this market by working with foreign brokers.

How to trade binary options then?

Fortunately, it’s not difficult to start trading options even if you are situated in India. It’s done in a few simple steps:

1. Open an account with a foreign broker. There’s no need to go abroad – you can undoubtedly do it on the web. However, you should be careful to choose a reliable broker who keeps promises and really pays the winnings.

2. Select the type of assets to trade. Most platforms have a rich choice of currencies and commodities, as well as stocks, futures, options, etc.

3. Assess the value patterns and make your predictions. The best merchants will have smart instruments that permit you to figure out the asset’s value.

4. Decide upon the amount of money to stake at the deal. You can assess the sum by looking at the likelihood of a result and the profit you’ll make by binary options trading.

5. Execute the trade on the platform.

6. Wait for the termination of trade. If your prediction gets fulfilled, you can either withdraw money or reinvest it. Do not forget that you risk losing everything, so start with modest sums until you get the understanding of how binary options trading works.

Remember: Since brokers are working globally, it implies that there is no legal protection for binary options traders in India.

Permission and regulation in India

There are no authorized binary options trading platforms or brokers in India, so you should work with a foreigh organization. Nonetheless, the public authority doesn’t step in, permitting you to openly partake in exchanging binary options. Obviously, that likewise implies there is no chance to return the deposit if you lose your money, so we’ll remind you again to pick assets wisely when you open an account with a foreign broker.

If you trade in India via foreign brokers, you might face legal complications because the activity is not legal. However, if you decide to declare your earnings, you should compile a tax report and mention the source of your income. Since your trading actions cannot be tracked, you will not be taxed automatically – reports should be compiled and sent manually.