Options Trading Strategies: A Guide for Beginners

Explore the most widespread option strategies with examples. Find out what they are used for, how to apply them and manage your assets more efficiently.

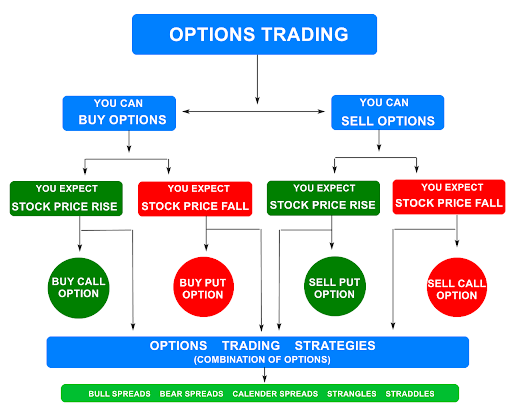

Call and put options are derivative contracts that permit purchasers (stakeholders) to purchase or sell a security at a picked cost. Asset purchasers are charged a sum called a “premium” by the merchants for a right. If price and market conditions become unfavorable for asset holders, they will allow the asset to stay worthless, guaranteeing the losses are not higher than the premium. Interestingly, option merchants expect more serious risk than the option purchasers, which is the reason they request this premium.

Options are categorized into two subtypes: “call” and “put”. With a call asset, the purchaser of the contract buys the option to purchase the basic resource in the future at a foreordained cost, which is called exercise cost or strike cost. With a put option, the purchaser obtains the right to sell the asset in the future at the foreordained cost. Now, when we’ve figured out what is call and put option is, it’s time to find out what makes them so efficient.

Contents

Why is trading options better than direct assets?

The call option and put options approach has several undeniable advantages. The Chicago Board of Options Exchange (CBOE) is the world’s biggest exchange for this purpose, offering assets on a wide assortment of single stocks, ETFs and indexes. Traders can build alternative techniques starting from purchasing or offering a solitary choice to exceptionally complex ones that include numerous synchronous option positions.

Let’s cast a closer look at the variety of call and put option trading strategies (and much more) for starters.

Purchasing Calls (Long Call)

This is the favored way of options trading for beginners who

- Are “bullish” or sure on an index, specific stock or ETF and need to restrict their risks;

- Need to use leverage to exploit rising costs.

Options are leveraged instruments, i.e., they permit merchants to enhance the advantage by handling smaller sums than would in some way or another be required if exchanging the fundamental asset. A standard option agreement on a stock controls 100 shares of the basic security.

Assume a broker wants to invest $5,000 in Tesla (TSLA), exchanging around $500 per share. With this sum, they can buy 10 offers. Assume then that the cost of the stock increases by 10% to $550 over the course of the following month. Disregarding any broker fees, commissions or exchange charges, the dealer’s portfolio will ascend to $5,500, leaving the broker with a net dollar return of 10% on the capital contributed.

Let’s observe another situation where Long Call may be the best option strategy. Suppose a call choice on the stock with a strike cost of $165 that terminates about a month from now costs $5.50 per share or $550 per contract. Given the broker’s accessible venture financial plan, they can purchase nine alternatives for an expense of $4,950. Since the alternative agreement controls 100 offers, the broker is instantly making an arrangement on 900 offers. If there’s no market call and the stock cost rises 10% to $181.50 at termination, the alternative will lapse in the cash and be valued at $16.50 per share ($181.50-$165 strike), or $14,850 on 900 offers. That is a net dollar return of $9,990, or 200% on the capital contributed, a much bigger return contrasted with exchanging the fundamental asset straightforwardly.

Risk/Profit ratio: The broker’s possible loss from a long call options strategy is restricted to the premium paid. Potential profit is limitless, as the option will increment alongside the fundamental asset cost until termination, and there is hypothetically no restriction to how high it can go.

Purchasing Puts (Long Put)

Such option trading strategies are recommended for traders who:

- Are bearish on a specific stock, index or ETF but want to face less risks with a short-selling technique;

- Need to use leverage to exploit falling costs.

A put option works the specific contrary way a call option does, with the first one acquiring value as the cost of the fundamental asset reduces. While short-selling additionally permits a dealer to benefit from falling costs, the risk with a short position is limitless, as there is hypothetically no restriction on how high a cost can rise. With a put option, if the fundamental asset rises past the option’s strike value, the option will essentially terminate worthlessly.

Risk/Profit ratio: With long put option trade, the potential loss is restricted to the premium paid for the alternatives. The highest profit from the position is limited since the hidden cost can’t dip under zero, however likewise with a long call choice, the put choice leverages the broker’s return.

Covered Call

This option trading strategy is recommended for merchants who:

- Anticipate no change or a slight expansion in the basic asset’s cost;

- Will restrict potential upside potential in return for some downside protection.

A covered call procedure involves purchasing 100 shares of the basic asset and selling a call option against those offers. At the point when the broker sells the call, the option’s premium is gathered, accordingly bringing down the asset’s cost basis and giving some downside protection. Consequently, by selling the option, the broker is consenting to sell shares of the fundamental at the option’s strike cost, along these lines covering the merchant’s gain potential. Here’s how such options strategies work.

Assume a merchant purchases 1,000 options of BP at the price of $44 per share and creates 10 call options (one agreement for every 100 shares) with a strike cost of $46 lapsing in one month, at an expense of $0.25 per share, or $25 per contract and $250 all out for the 10 agreements. The $0.25 premium diminishes the expense premise on the shares to $43.75, so any drop in the hidden down to this point will be counterbalanced by the premium received from the choice position, consequently offering restricted downside security.

If the asset value transcends $46 before termination, the short call option will be worked out (or “summoned”), which means the broker should convey the stock at the options strike cost. In this situation, the dealer will earn $2.25 per share ($46 strike cost – $43.75 cost premise).

Yet, this model of trading options infers the broker doesn’t anticipate that BP should move above $46 or fundamentally underneath $44 throughout the following month. While options don’t transcend $46 and get called away before the option terminates, the dealer will keep the premium without a worry and maybe selling calls against the offers whenever wanted.

Risk/Profit ratio: If the offer value transcends the strike cost before the lapse, the short call option can be practiced and the broker should convey shares of the basic asset at the option’s strike cost, regardless of whether it is beneath the market cost. In return for this risk, a covered call tactic gives restricted downside protection as a premium when selling the call option.

Protective Put

This is the favored option strategy for merchants who own the basic asset and need downside protection.

A protective put is a long-term put, similar to the methodology we talked about above. Nonetheless, the objective, as the name suggests, is downside protection of a put and call option as opposed to endeavoring to benefit from a drawback move. In the event that a dealer owns assets with a bullish trend over the long haul yet needs to secure against a decrease in the short run, they might buy a protective put.

How to trade in options with a protective put?

If the value of the basic asset increments and exceeds the put’s strike cost at development, the option lapses worthless and the broker loses the premium yet has the advantage of the expanded fundamental cost. Then again, if the basic value diminishes, the merchant’s portfolio position loses value, yet this loss is to a great extent covered by the increase from the put option position. Subsequently, the position can be considered as an insurance methodology.

The merchant can set the strike cost underneath the current cost to lessen premium installment to the detriment of diminishing downside protection. This can be considered as deductible protection. Assume, for instance, that a market player purchases 1,000 shares of Coca-Cola (KO) at a cost of $44 and needs to protect the put and call options from negative price movements over the course of the following two months.

The expense of insurance increments with the level thereof. For instance, assuming the broker needs to secure the speculation against any drop in value, they can purchase 10 at-the-money put choices at a strike cost of $44 for $1.23 per share, or $123 per contract, for a general cost of $1,230. Notwithstanding, if the merchant will endure some degree of downside risk, picking a less costly out-of-the-money option, for example, a $40 put could likewise work. For this situation, the expense of the choice position will be lower at $200.

Risk/Profit ratio: If the cost of the basic asset stays the same or rises, the potential loss will be restricted to the option premium, which is paid as insurance. Assuming the cost of the basic asset drops, the loss in the capital will be counterbalanced by an increment in the option’s cost and is restricted to the difference between the underlying stock cost and strike cost in addition to the premium paid for the option. As shown in the previous case at the strike cost of $40, the loss is restricted to $4.20 per share ($44 – $40 + $0.20).

Other Options Strategies

These options trading strategies might be somewhat more perplexing than essentially purchasing calls or puts, however, they are intended to assist you with efficient risk management when you trade options:

- Covered call methodology (buy-write strategy).

- Stocks are purchased, and the trader sells call options on a similar stock. The quantity of shares you purchased ought to be the same as the quantity of call option contracts you sold.

- Married Put Strategy. After purchasing a stock, the trader purchases put alternatives for a comparable number of shares. This approach works like a protection strategy against short-term losses call options with a particular strike cost. You’ll sell a similar number of call options at a higher strike cost.

- Protective Collar Strategy. A trader purchases an out-of-the-money put option, while simultaneously composing an out-of-the-money call option for a similar stock.

- Long Straddle Strategy. A trader purchases a call option and a put option simultaneously. For such option hedging strategies, two options ought to have a similar strike cost and lapse date.

The Conclusion

Options offer elective methodologies for investors to benefit from trading basic assets. There’s a large choice of option trading methodologies including various blends of options, underlying assets and different derivatives. Essential methodologies for amateurs incorporate purchasing calls and puts, selling covered calls and purchasing protective puts – they can be learned through an options trading tutorial.

There are benefits to exchanging options as opposed to underlying assets, like downside protection and leverage returns, yet there are likewise drawbacks like the necessity for forthright premium payment. The initial step to exchanging options is to pick a broker, after which you can experiment with various option strategies and approaches to figure out the most efficient one.